The Qingdao Kingking Applied Chemistry Co., Ltd. (SZSE:002094) share price has fared very poorly over the last month, falling by a substantial 29%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 46% share price drop.

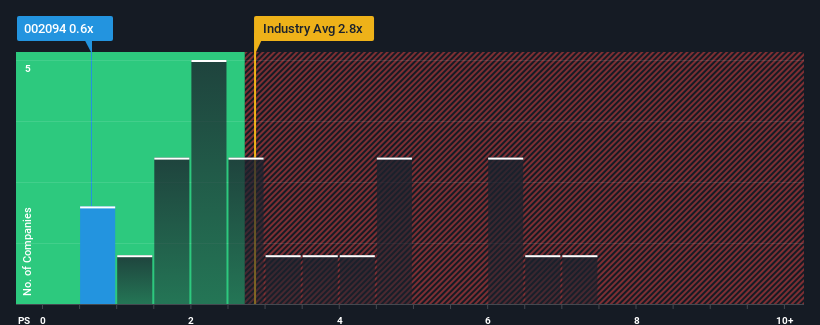

Following the heavy fall in price, Qingdao Kingking Applied Chemistry may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.6x, considering almost half of all companies in the Personal Products industry in China have P/S ratios greater than 2.8x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

What Does Qingdao Kingking Applied Chemistry's Recent Performance Look Like?

For instance, Qingdao Kingking Applied Chemistry's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Qingdao Kingking Applied Chemistry, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Qingdao Kingking Applied Chemistry?

The only time you'd be truly comfortable seeing a P/S as depressed as Qingdao Kingking Applied Chemistry's is when the company's growth is on track to lag the industry decidedly.

The only time you'd be truly comfortable seeing a P/S as depressed as Qingdao Kingking Applied Chemistry's is when the company's growth is on track to lag the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 27%. As a result, revenue from three years ago have also fallen 51% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 22% shows it's an unpleasant look.

In light of this, it's understandable that Qingdao Kingking Applied Chemistry's P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

Qingdao Kingking Applied Chemistry's P/S looks about as weak as its stock price lately. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Qingdao Kingking Applied Chemistry maintains its low P/S off the back of its sliding revenue over the medium-term. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Qingdao Kingking Applied Chemistry, and understanding should be part of your investment process.

If you're unsure about the strength of Qingdao Kingking Applied Chemistry's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.