To the annoyance of some shareholders, Shanghai General Healthy Information and Technology Co., Ltd. (SHSE:605186) shares are down a considerable 30% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 43% share price drop.

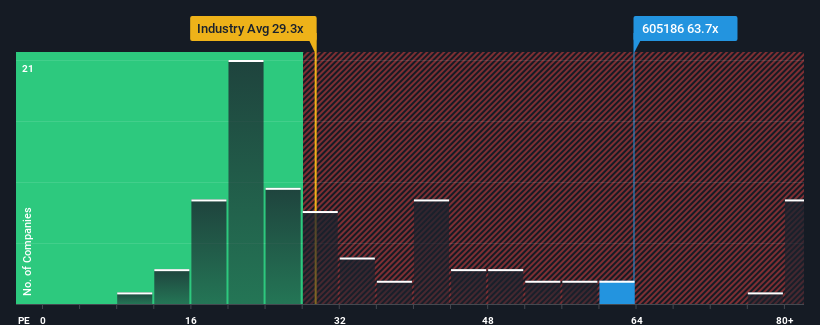

Even after such a large drop in price, Shanghai General Healthy Information and Technology's price-to-earnings (or "P/E") ratio of 63.7x might still make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 30x and even P/E's below 18x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Shanghai General Healthy Information and Technology could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Shanghai General Healthy Information and Technology would need to produce outstanding growth well in excess of the market.

In order to justify its P/E ratio, Shanghai General Healthy Information and Technology would need to produce outstanding growth well in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 52%. This means it has also seen a slide in earnings over the longer-term as EPS is down 54% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 48% per year during the coming three years according to the two analysts following the company. That's shaping up to be materially higher than the 25% per year growth forecast for the broader market.

In light of this, it's understandable that Shanghai General Healthy Information and Technology's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shanghai General Healthy Information and Technology's shares may have retreated, but its P/E is still flying high. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Shanghai General Healthy Information and Technology maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Shanghai General Healthy Information and Technology you should know about.

If you're unsure about the strength of Shanghai General Healthy Information and Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.