The Shanghai Welltech Automation Co.,Ltd. (SZSE:002058) share price has fared very poorly over the last month, falling by a substantial 32%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 35% share price drop.

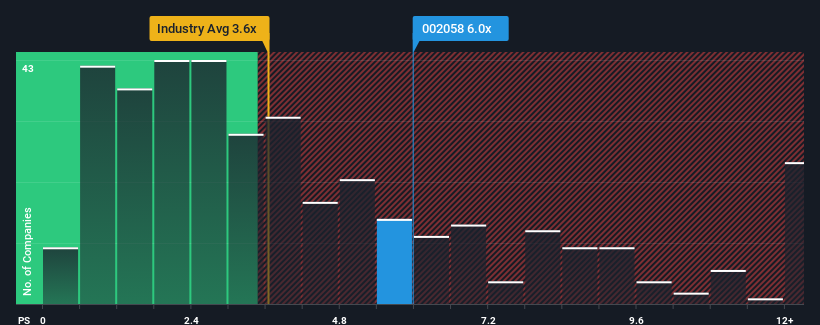

Although its price has dipped substantially, given around half the companies in China's Electronic industry have price-to-sales ratios (or "P/S") below 3.6x, you may still consider Shanghai Welltech AutomationLtd as a stock to avoid entirely with its 6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Shanghai Welltech AutomationLtd Has Been Performing

Revenue has risen firmly for Shanghai Welltech AutomationLtd recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Shanghai Welltech AutomationLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Shanghai Welltech AutomationLtd would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 21% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 26% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Shanghai Welltech AutomationLtd is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Final Word

Shanghai Welltech AutomationLtd's shares may have suffered, but its P/S remains high. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Shanghai Welltech AutomationLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

You should always think about risks. Case in point, we've spotted 2 warning signs for Shanghai Welltech AutomationLtd you should be aware of, and 1 of them is potentially serious.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.