Statistically speaking, long term investing is a profitable endeavour. But along the way some stocks are going to perform badly. Zooming in on an example, the Hebei Sailhero Environmental Protection High-tech Co.,Ltd (SZSE:300137) share price dropped 54% in the last half decade. That is extremely sub-optimal, to say the least. We also note that the stock has performed poorly over the last year, with the share price down 38%. Unfortunately the share price momentum is still quite negative, with prices down 34% in thirty days.

Since Hebei Sailhero Environmental Protection High-techLtd has shed CN¥816m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Hebei Sailhero Environmental Protection High-techLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over half a decade Hebei Sailhero Environmental Protection High-techLtd reduced its trailing twelve month revenue by 8.9% for each year. That puts it in an unattractive cohort, to put it mildly. It seems appropriate, then, that the share price slid about 9% annually during that time. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. This looks like a really risky stock to buy, at a glance.

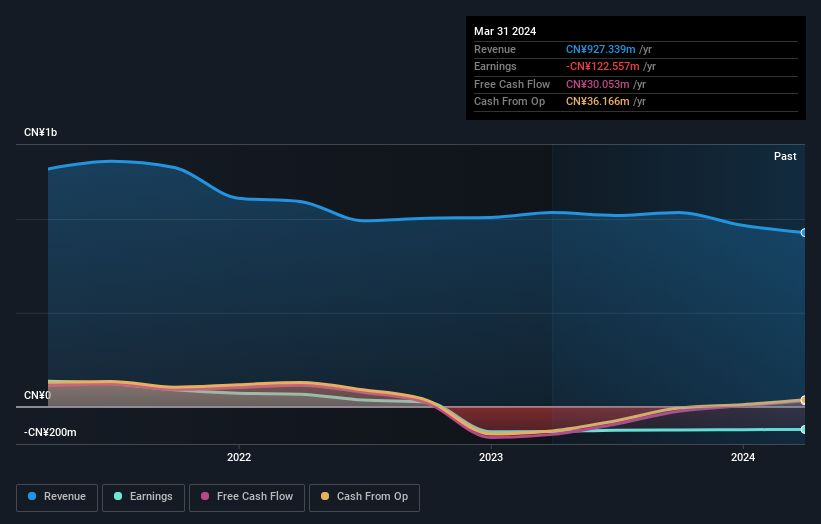

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Hebei Sailhero Environmental Protection High-techLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered Hebei Sailhero Environmental Protection High-techLtd's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Hebei Sailhero Environmental Protection High-techLtd's TSR, which was a 52% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

While the broader market lost about 12% in the twelve months, Hebei Sailhero Environmental Protection High-techLtd shareholders did even worse, losing 38%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Hebei Sailhero Environmental Protection High-techLtd is showing 2 warning signs in our investment analysis , and 1 of those can't be ignored...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.