JTF International Holdings Limited (HKG:9689) shares have had a horrible month, losing 29% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

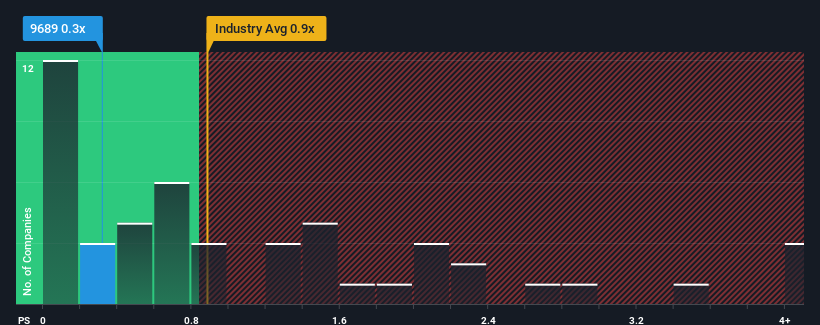

After such a large drop in price, when close to half the companies operating in Hong Kong's Oil and Gas industry have price-to-sales ratios (or "P/S") above 0.9x, you may consider JTF International Holdings as an enticing stock to check out with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How JTF International Holdings Has Been Performing

For example, consider that JTF International Holdings' financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for JTF International Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For JTF International Holdings?

The only time you'd be truly comfortable seeing a P/S as low as JTF International Holdings' is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as JTF International Holdings' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 13% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 2.9% shows it's about the same on an annualised basis.

With this information, we find it odd that JTF International Holdings is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

What Does JTF International Holdings' P/S Mean For Investors?

JTF International Holdings' P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that JTF International Holdings currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with JTF International Holdings (including 1 which is concerning).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.