Unfortunately for some shareholders, the China Tourism And Culture Investment Group Co.,Ltd (SHSE:600358) share price has dived 26% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 53% share price decline.

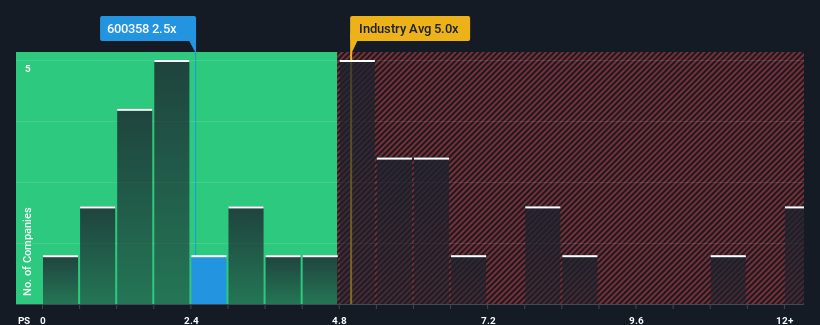

Following the heavy fall in price, considering about half the companies operating in China's Hospitality industry have price-to-sales ratios (or "P/S") above 5x, you may consider China Tourism And Culture Investment GroupLtd as an great investment opportunity with its 2.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

What Does China Tourism And Culture Investment GroupLtd's Recent Performance Look Like?

For example, consider that China Tourism And Culture Investment GroupLtd's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on China Tourism And Culture Investment GroupLtd's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For China Tourism And Culture Investment GroupLtd?

China Tourism And Culture Investment GroupLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

China Tourism And Culture Investment GroupLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a frustrating 1.6% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 11% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 27% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we are not surprised that China Tourism And Culture Investment GroupLtd is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On China Tourism And Culture Investment GroupLtd's P/S

China Tourism And Culture Investment GroupLtd's P/S looks about as weak as its stock price lately. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of China Tourism And Culture Investment GroupLtd confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for China Tourism And Culture Investment GroupLtd with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.