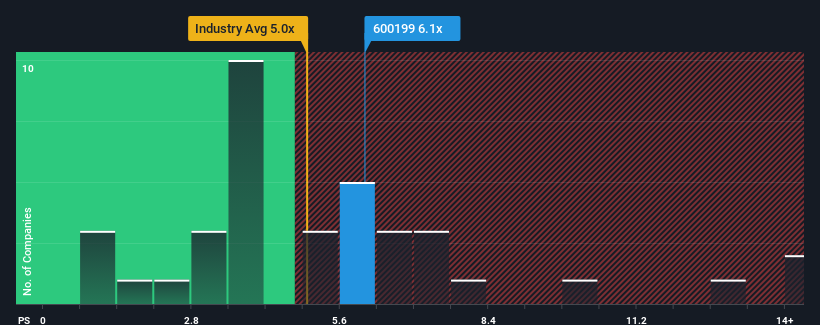

Anhui Golden Seed Winery Co., Ltd.'s (SHSE:600199) price-to-sales (or "P/S") ratio of 6.1x may not look like an appealing investment opportunity when you consider close to half the companies in the Beverage industry in China have P/S ratios below 5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

How Anhui Golden Seed Winery Has Been Performing

Recent times haven't been great for Anhui Golden Seed Winery as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Anhui Golden Seed Winery.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Anhui Golden Seed Winery's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. Revenue has also lifted 28% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 27% during the coming year according to the five analysts following the company. With the industry only predicted to deliver 16%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Anhui Golden Seed Winery's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Anhui Golden Seed Winery shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Anhui Golden Seed Winery, and understanding should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.