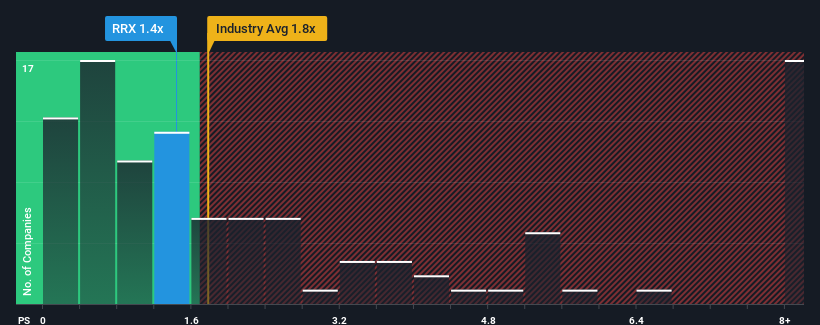

There wouldn't be many who think Regal Rexnord Corporation's (NYSE:RRX) price-to-sales (or "P/S") ratio of 1.4x is worth a mention when the median P/S for the Electrical industry in the United States is similar at about 1.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does Regal Rexnord's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Regal Rexnord has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Regal Rexnord.Is There Some Revenue Growth Forecasted For Regal Rexnord?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Regal Rexnord's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 28% last year. The latest three year period has also seen an excellent 120% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 4.9% as estimated by the eight analysts watching the company. Meanwhile, the broader industry is forecast to expand by 13%, which paints a poor picture.

With this information, we find it concerning that Regal Rexnord is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Regal Rexnord's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

While Regal Rexnord's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Plus, you should also learn about this 1 warning sign we've spotted with Regal Rexnord.

If these risks are making you reconsider your opinion on Regal Rexnord, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.