Key Insights

- Cirtek Holdings to hold its Annual General Meeting on 21st of June

- CEO Candy Law's total compensation includes salary of HK$1.31m

- Total compensation is similar to the industry average

- Cirtek Holdings' three-year loss to shareholders was 29% while its EPS was down 74% over the past three years

The results at Cirtek Holdings Limited (HKG:1433) have been quite disappointing recently and CEO Candy Law bears some responsibility for this. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 21st of June. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. From our analysis, we think CEO compensation may need a review in light of the recent performance.

Comparing Cirtek Holdings Limited's CEO Compensation With The Industry

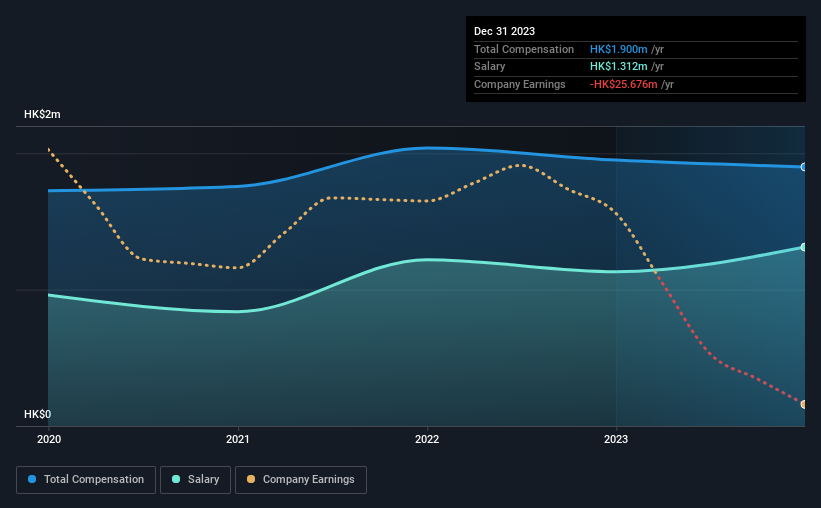

At the time of writing, our data shows that Cirtek Holdings Limited has a market capitalization of HK$74m, and reported total annual CEO compensation of HK$1.9m for the year to December 2023. That's mostly flat as compared to the prior year's compensation. In particular, the salary of HK$1.31m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the Hong Kong Luxury industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was HK$2.0m. So it looks like Cirtek Holdings compensates Candy Law in line with the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$1.3m | HK$1.1m | 69% |

| Other | HK$588k | HK$818k | 31% |

| Total Compensation | HK$1.9m | HK$2.0m | 100% |

Speaking on an industry level, nearly 94% of total compensation represents salary, while the remainder of 6% is other remuneration. It's interesting to note that Cirtek Holdings allocates a smaller portion of compensation to salary in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Cirtek Holdings Limited's Growth

Over the last three years, Cirtek Holdings Limited has shrunk its earnings per share by 74% per year. In the last year, its revenue is down 8.9%.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Cirtek Holdings Limited Been A Good Investment?

Given the total shareholder loss of 29% over three years, many shareholders in Cirtek Holdings Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 2 warning signs for Cirtek Holdings that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com