Unfortunately for some shareholders, the Shenzhen SDG Information Co., Ltd. (SZSE:000070) share price has dived 28% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 56% share price decline.

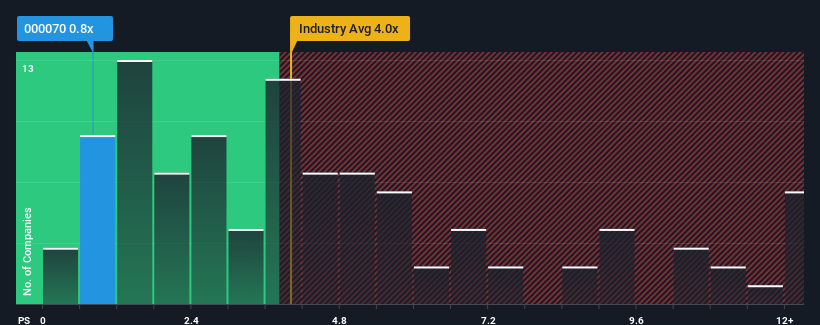

After such a large drop in price, Shenzhen SDG Information's price-to-sales (or "P/S") ratio of 0.8x might make it look like a strong buy right now compared to the wider Communications industry in China, where around half of the companies have P/S ratios above 4x and even P/S above 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

How Has Shenzhen SDG Information Performed Recently?

The revenue growth achieved at Shenzhen SDG Information over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on Shenzhen SDG Information will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Shenzhen SDG Information, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Shenzhen SDG Information's is when the company's growth is on track to lag the industry decidedly.

The only time you'd be truly comfortable seeing a P/S as depressed as Shenzhen SDG Information's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 15% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 10% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 47% shows it's an unpleasant look.

With this information, we are not surprised that Shenzhen SDG Information is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Key Takeaway

Shenzhen SDG Information's P/S looks about as weak as its stock price lately. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Shenzhen SDG Information confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 3 warning signs for Shenzhen SDG Information (2 shouldn't be ignored!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com