Unfortunately for some shareholders, the Hunan Mendale Hometextile Co.,Ltd (SZSE:002397) share price has dived 26% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

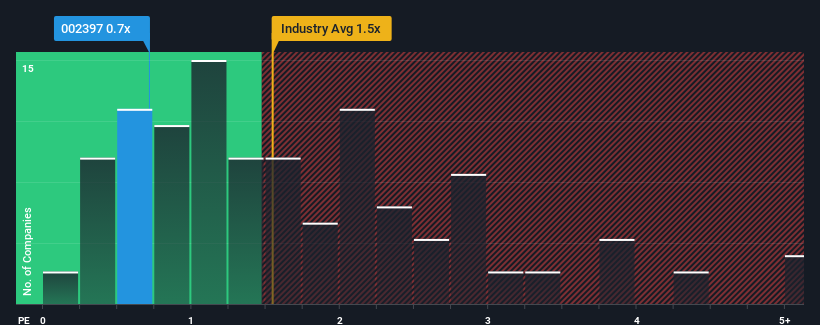

In spite of the heavy fall in price, it would still be understandable if you think Hunan Mendale HometextileLtd is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.7x, considering almost half the companies in China's Luxury industry have P/S ratios above 1.5x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has Hunan Mendale HometextileLtd Performed Recently?

Revenue has risen at a steady rate over the last year for Hunan Mendale HometextileLtd, which is generally not a bad outcome. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Hunan Mendale HometextileLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

Hunan Mendale HometextileLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 6.1% gain to the company's revenues. Still, lamentably revenue has fallen 11% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 16% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that Hunan Mendale HometextileLtd's P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What We Can Learn From Hunan Mendale HometextileLtd's P/S?

The southerly movements of Hunan Mendale HometextileLtd's shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that Hunan Mendale HometextileLtd maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Hunan Mendale HometextileLtd (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com