Fosun Tourism Group (HKG:1992) shares have had a horrible month, losing 27% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 50% loss during that time.

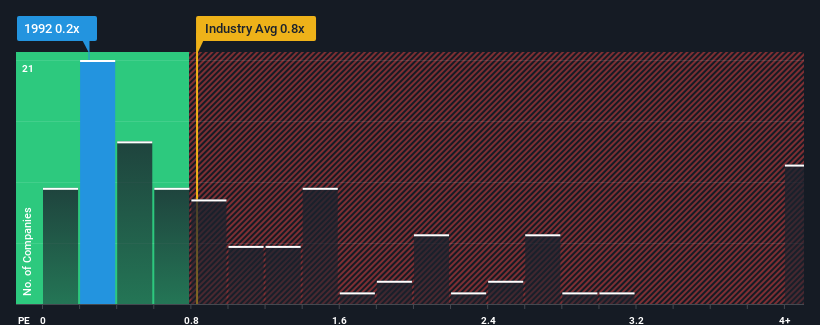

Even after such a large drop in price, it would still be understandable if you think Fosun Tourism Group is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in Hong Kong's Hospitality industry have P/S ratios above 0.8x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Fosun Tourism Group's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Fosun Tourism Group has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Fosun Tourism Group will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Fosun Tourism Group?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Fosun Tourism Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. The strong recent performance means it was also able to grow revenue by 143% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 9.3% per year during the coming three years according to the seven analysts following the company. That's shaping up to be materially lower than the 15% each year growth forecast for the broader industry.

With this in consideration, its clear as to why Fosun Tourism Group's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Fosun Tourism Group's P/S

The southerly movements of Fosun Tourism Group's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Fosun Tourism Group maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Fosun Tourism Group that we have uncovered.

If these risks are making you reconsider your opinion on Fosun Tourism Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com