Vistar Holdings Limited (HKG:8535) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 57% share price drop in the last twelve months.

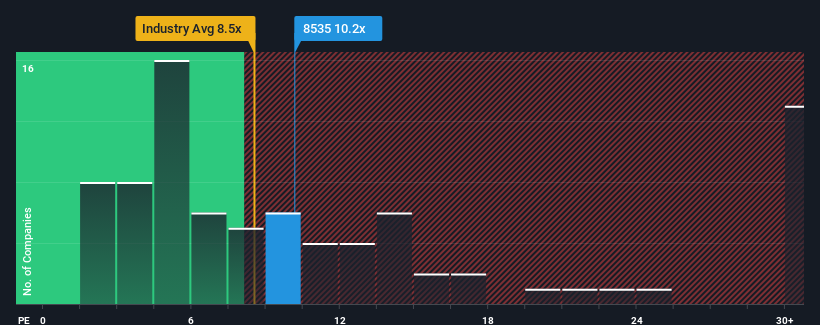

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Vistar Holdings' P/E ratio of 10.2x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 10x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Vistar Holdings has been doing a decent job lately as it's been growing earnings at a reasonable pace. One possibility is that the P/E is moderate because investors think this good earnings growth might only be parallel to the broader market in the near future. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Vistar Holdings would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a worthy increase of 3.8%. Still, lamentably EPS has fallen 82% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 21% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's somewhat alarming that Vistar Holdings' P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

Vistar Holdings' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Vistar Holdings currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Vistar Holdings that you should be aware of.

Of course, you might also be able to find a better stock than Vistar Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com