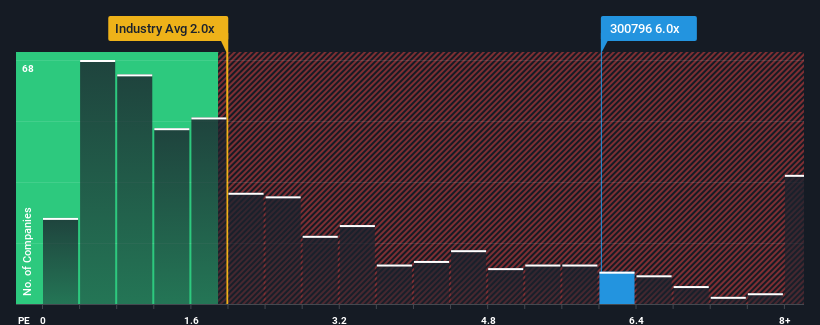

BSM Chemical Co.,Ltd.'s (SZSE:300796) price-to-sales (or "P/S") ratio of 6x may look like a poor investment opportunity when you consider close to half the companies in the Chemicals industry in China have P/S ratios below 2x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Has BSM ChemicalLtd Performed Recently?

With revenue growth that's superior to most other companies of late, BSM ChemicalLtd has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think BSM ChemicalLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is BSM ChemicalLtd's Revenue Growth Trending?

BSM ChemicalLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a decent 3.5% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 72% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 121% during the coming year according to the lone analyst following the company. With the industry only predicted to deliver 23%, the company is positioned for a stronger revenue result.

With this information, we can see why BSM ChemicalLtd is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into BSM ChemicalLtd shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It is also worth noting that we have found 2 warning signs for BSM ChemicalLtd (1 is potentially serious!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com