A-Living Smart City Services Co., Ltd. (HKG:3319) shares have had a horrible month, losing 27% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

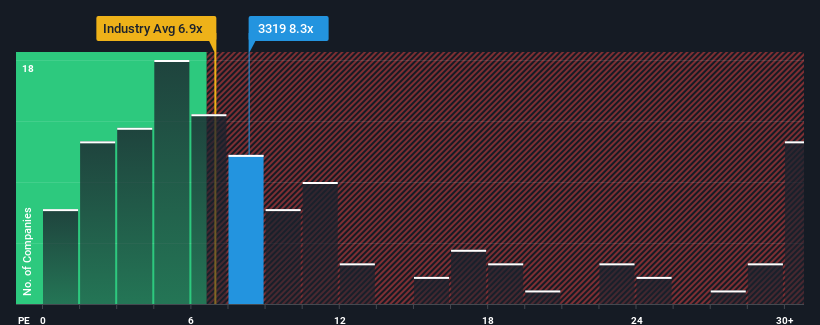

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about A-Living Smart City Services' P/E ratio of 8.3x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 10x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, A-Living Smart City Services' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

How Is A-Living Smart City Services' Growth Trending?

In order to justify its P/E ratio, A-Living Smart City Services would need to produce growth that's similar to the market.

In order to justify its P/E ratio, A-Living Smart City Services would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 75% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 75% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 40% each year as estimated by the eleven analysts watching the company. With the market only predicted to deliver 16% each year, the company is positioned for a stronger earnings result.

With this information, we find it interesting that A-Living Smart City Services is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

With its share price falling into a hole, the P/E for A-Living Smart City Services looks quite average now. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that A-Living Smart City Services currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with A-Living Smart City Services.

You might be able to find a better investment than A-Living Smart City Services. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com