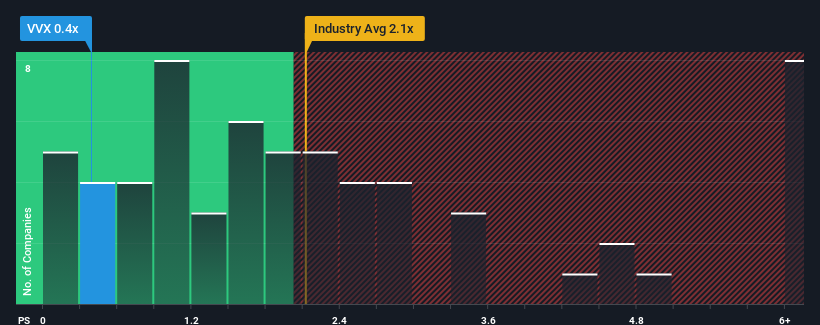

V2X, Inc.'s (NYSE:VVX) price-to-sales (or "P/S") ratio of 0.4x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Aerospace & Defense industry in the United States have P/S ratios greater than 2.1x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does V2X's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, V2X has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on V2X will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

V2X's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. The strong recent performance means it was also able to grow revenue by 173% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should demonstrate some strength in company's business, generating growth of 4.8% as estimated by the six analysts watching the company. Meanwhile, the broader industry is forecast to contract by 3.5%, which would indicate the company is doing better than the majority of its peers.

In light of this, it's quite peculiar that V2X's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Bottom Line On V2X's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into V2X's analyst forecasts has shown that it could be trading at a significant discount in terms of P/S, as it is expected to far outperform the industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

Having said that, be aware V2X is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com