Whales with a lot of money to spend have taken a noticeably bearish stance on Lowe's Companies.

Looking at options history for Lowe's Companies (NYSE:LOW) we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 58% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $327,314 and 7, calls, for a total amount of $400,191.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $200.0 to $270.0 for Lowe's Companies over the recent three months.

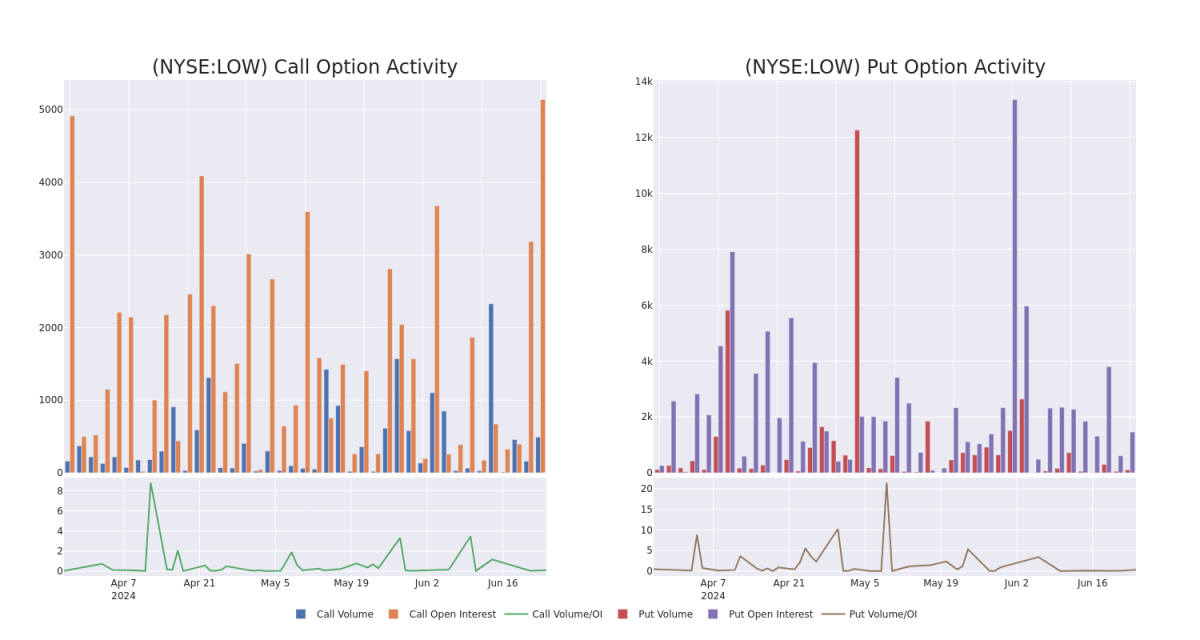

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Lowe's Companies's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Lowe's Companies's whale trades within a strike price range from $200.0 to $270.0 in the last 30 days.

Lowe's Companies Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LOW | CALL | SWEEP | BULLISH | 01/16/26 | $15.2 | $15.15 | $15.18 | $270.00 | $168.7K | 187 | 42 |

| LOW | PUT | SWEEP | NEUTRAL | 01/16/26 | $18.65 | $18.55 | $18.59 | $220.00 | $122.8K | 368 | 36 |

| LOW | PUT | SWEEP | NEUTRAL | 01/16/26 | $12.45 | $12.4 | $12.48 | $200.00 | $78.5K | 321 | 70 |

| LOW | CALL | TRADE | BEARISH | 01/17/25 | $17.85 | $17.65 | $17.65 | $230.00 | $68.8K | 1.9K | 1 |

| LOW | PUT | SWEEP | BEARISH | 06/20/25 | $18.5 | $18.45 | $18.5 | $230.00 | $46.2K | 771 | 0 |

About Lowe's Companies

Lowe's is the second-largest home improvement retailer in the world, operating more than 1,700 stores in the United States, after the 2023 divestiture of its Canadian locations (RONA, Lowe's Canada, Réno-Dépôt, and Dick's Lumber). The firm's stores offer products and services for home decorating, maintenance, repair, and remodeling, with maintenance and repair accounting for two thirds of products sold. Lowe's targets retail do-it-yourself (around 75% of sales) and do-it-for-me customers as well as commercial and professional business clients (around 25% of sales). We estimate Lowe's captures a high-single-digit share of the domestic home improvement market, based on US Census data and management's market size estimates.

Following our analysis of the options activities associated with Lowe's Companies, we pivot to a closer look at the company's own performance.

Lowe's Companies's Current Market Status

- With a volume of 1,606,188, the price of LOW is down -0.12% at $228.31.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 57 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.