It's normal to be annoyed when stock you own has a declining share price. But sometimes a share price fall can have more to do with market conditions than the performance of the specific business. The Shenzhen SEG Co.,Ltd (SZSE:000058) is down 13% over a year, but the total shareholder return is -12% once you include the dividend. That's better than the market which declined 14% over the last year. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 7.9% in three years. In the last ninety days we've seen the share price slide 19%.

If the past week is anything to go by, investor sentiment for Shenzhen SEGLtd isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Shenzhen SEGLtd saw its earnings per share increase strongly. The rate of growth may not be sustainable, but it is still really positive. As you can imagine, the share price action therefore perturbs us. Some different data might shed some more light on the situation.

During the last year Shenzhen SEGLtd saw its earnings per share increase strongly. The rate of growth may not be sustainable, but it is still really positive. As you can imagine, the share price action therefore perturbs us. Some different data might shed some more light on the situation.

With a low yield of 0.6% we doubt that the dividend influences the share price much. Shenzhen SEGLtd's revenue is actually up 6.4% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

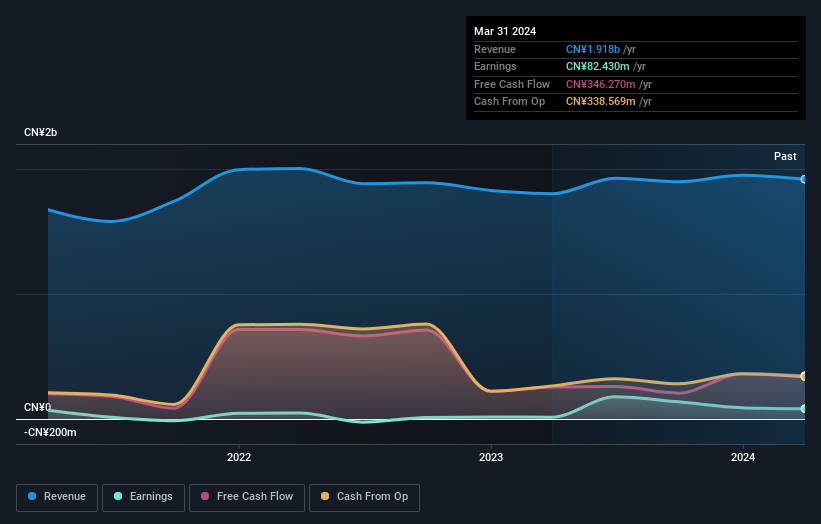

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Shenzhen SEGLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While it's certainly disappointing to see that Shenzhen SEGLtd shares lost 12% throughout the year, that wasn't as bad as the market loss of 14%. Unfortunately, last year's performance may indicate unresolved challenges, given that it's worse than the annualised loss of 1.0% over the last half decade. Whilst Baron Rothschild does tell the investor "buy when there's blood in the streets, even if the blood is your own", buyers would need to examine the data carefully to be comfortable that the business itself is sound. It's always interesting to track share price performance over the longer term. But to understand Shenzhen SEGLtd better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Shenzhen SEGLtd , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com