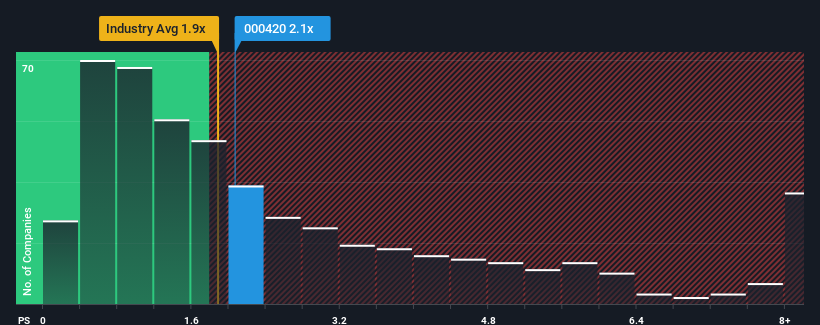

There wouldn't be many who think Jilin Chemical Fibre Stock Co.,Ltd's (SZSE:000420) price-to-sales (or "P/S") ratio of 2.1x is worth a mention when the median P/S for the Chemicals industry in China is similar at about 1.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Jilin Chemical Fibre StockLtd's Recent Performance Look Like?

There hasn't been much to differentiate Jilin Chemical Fibre StockLtd's and the industry's revenue growth lately. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Jilin Chemical Fibre StockLtd.How Is Jilin Chemical Fibre StockLtd's Revenue Growth Trending?

Jilin Chemical Fibre StockLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Although pleasingly revenue has lifted 49% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Looking ahead now, revenue is anticipated to climb by 18% per annum during the coming three years according to the dual analysts following the company. That's shaping up to be materially higher than the 15% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Jilin Chemical Fibre StockLtd's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Jilin Chemical Fibre StockLtd's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Jilin Chemical Fibre StockLtd's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Jilin Chemical Fibre StockLtd (1 shouldn't be ignored!) that you should be aware of.

If you're unsure about the strength of Jilin Chemical Fibre StockLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com