The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Zhejiang Asia-Pacific Mechanical & Electronic Co.,Ltd (SZSE:002284) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

How Much Debt Does Zhejiang Asia-Pacific Mechanical & ElectronicLtd Carry?

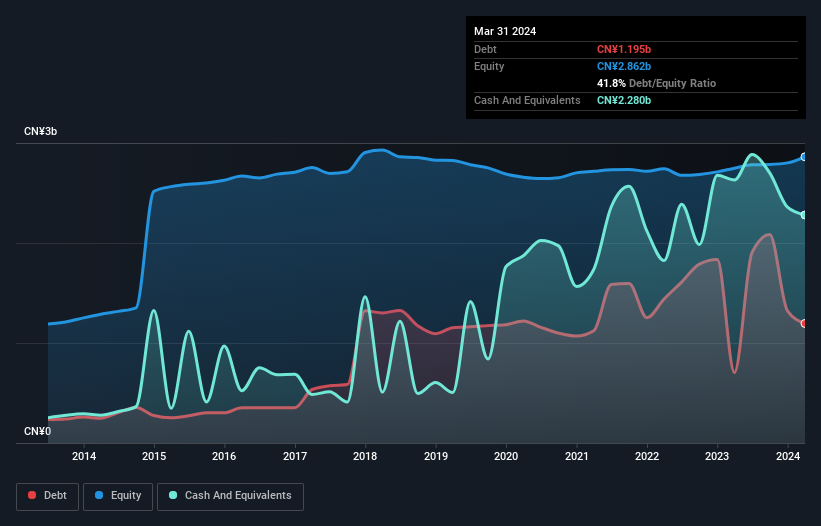

As you can see below, at the end of March 2024, Zhejiang Asia-Pacific Mechanical & ElectronicLtd had CN¥1.20b of debt, up from CN¥704.6m a year ago. Click the image for more detail. But on the other hand it also has CN¥2.28b in cash, leading to a CN¥1.08b net cash position.

How Healthy Is Zhejiang Asia-Pacific Mechanical & ElectronicLtd's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Zhejiang Asia-Pacific Mechanical & ElectronicLtd had liabilities of CN¥3.34b due within 12 months and liabilities of CN¥149.0m due beyond that. On the other hand, it had cash of CN¥2.28b and CN¥1.30b worth of receivables due within a year. So it actually has CN¥93.7m more liquid assets than total liabilities.

Zooming in on the latest balance sheet data, we can see that Zhejiang Asia-Pacific Mechanical & ElectronicLtd had liabilities of CN¥3.34b due within 12 months and liabilities of CN¥149.0m due beyond that. On the other hand, it had cash of CN¥2.28b and CN¥1.30b worth of receivables due within a year. So it actually has CN¥93.7m more liquid assets than total liabilities.

This state of affairs indicates that Zhejiang Asia-Pacific Mechanical & ElectronicLtd's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the CN¥5.09b company is short on cash, but still worth keeping an eye on the balance sheet. Simply put, the fact that Zhejiang Asia-Pacific Mechanical & ElectronicLtd has more cash than debt is arguably a good indication that it can manage its debt safely.

Pleasingly, Zhejiang Asia-Pacific Mechanical & ElectronicLtd is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 260% gain in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Zhejiang Asia-Pacific Mechanical & ElectronicLtd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Zhejiang Asia-Pacific Mechanical & ElectronicLtd may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, Zhejiang Asia-Pacific Mechanical & ElectronicLtd actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing Up

While it is always sensible to investigate a company's debt, in this case Zhejiang Asia-Pacific Mechanical & ElectronicLtd has CN¥1.08b in net cash and a decent-looking balance sheet. The cherry on top was that in converted 387% of that EBIT to free cash flow, bringing in CN¥263m. So we don't think Zhejiang Asia-Pacific Mechanical & ElectronicLtd's use of debt is risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example - Zhejiang Asia-Pacific Mechanical & ElectronicLtd has 1 warning sign we think you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com