It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Molina Healthcare (NYSE:MOH). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Molina Healthcare with the means to add long-term value to shareholders.

How Fast Is Molina Healthcare Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. We can see that in the last three years Molina Healthcare grew its EPS by 14% per year. That growth rate is fairly good, assuming the company can keep it up.

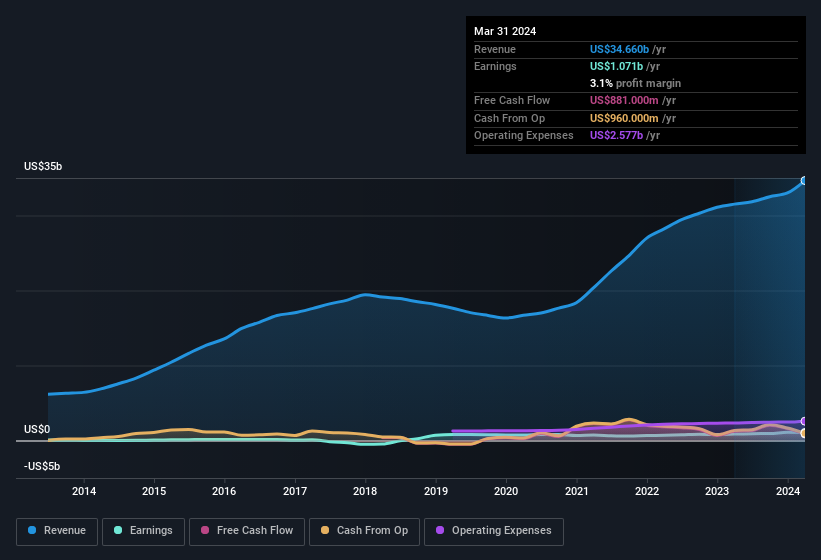

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Molina Healthcare achieved similar EBIT margins to last year, revenue grew by a solid 10.0% to US$35b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Molina Healthcare's future EPS 100% free.

Are Molina Healthcare Insiders Aligned With All Shareholders?

Since Molina Healthcare has a market capitalisation of US$18b, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. We note that their impressive stake in the company is worth US$198m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Is Molina Healthcare Worth Keeping An Eye On?

One important encouraging feature of Molina Healthcare is that it is growing profits. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. Of course, just because Molina Healthcare is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Although Molina Healthcare certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com