Those holding Sichuan Huati Lighting Technology Co.,Ltd. (SHSE:603679) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.7% in the last twelve months.

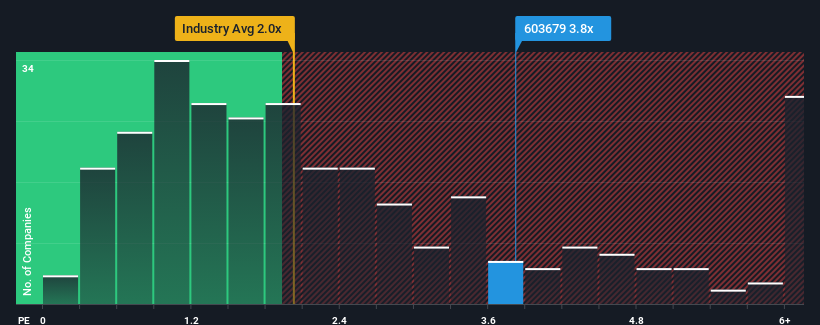

Since its price has surged higher, when almost half of the companies in China's Electrical industry have price-to-sales ratios (or "P/S") below 2x, you may consider Sichuan Huati Lighting TechnologyLtd as a stock probably not worth researching with its 3.8x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How Has Sichuan Huati Lighting TechnologyLtd Performed Recently?

Sichuan Huati Lighting TechnologyLtd has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sichuan Huati Lighting TechnologyLtd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Sichuan Huati Lighting TechnologyLtd's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 5.6% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 23% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that Sichuan Huati Lighting TechnologyLtd's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Sichuan Huati Lighting TechnologyLtd's P/S Mean For Investors?

Sichuan Huati Lighting TechnologyLtd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Sichuan Huati Lighting TechnologyLtd currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You need to take note of risks, for example - Sichuan Huati Lighting TechnologyLtd has 4 warning signs (and 2 which shouldn't be ignored) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com