The Enviro Energy International Holdings Limited (HKG:1102) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. Looking at the bigger picture, even after this poor month the stock is up 75% in the last year.

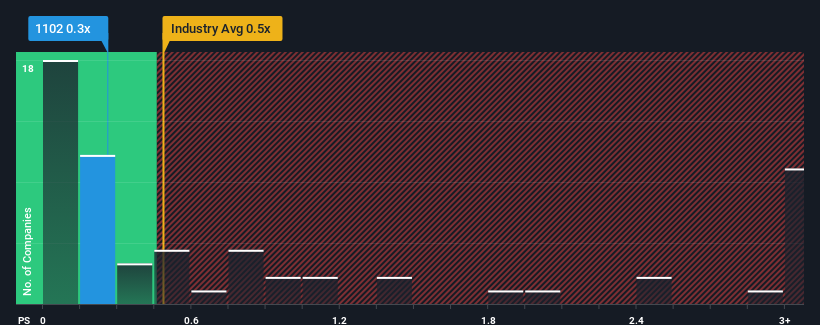

In spite of the heavy fall in price, there still wouldn't be many who think Enviro Energy International Holdings' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Hong Kong's Trade Distributors industry is similar at about 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Has Enviro Energy International Holdings Performed Recently?

With revenue growth that's exceedingly strong of late, Enviro Energy International Holdings has been doing very well. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Enviro Energy International Holdings' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Enviro Energy International Holdings' is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like Enviro Energy International Holdings' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 97% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 34% shows it's noticeably more attractive.

In light of this, it's curious that Enviro Energy International Holdings' P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Enviro Energy International Holdings' P/S?

With its share price dropping off a cliff, the P/S for Enviro Energy International Holdings looks to be in line with the rest of the Trade Distributors industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Enviro Energy International Holdings currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Having said that, be aware Enviro Energy International Holdings is showing 5 warning signs in our investment analysis, and 4 of those don't sit too well with us.

If you're unsure about the strength of Enviro Energy International Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com