One of the frustrations of investing is when a stock goes down. But it can difficult to make money in a declining market. While the Shandong Iron and Steel Company Ltd. (SHSE:600022) share price is down 27% in the last three years, the total return to shareholders (which includes dividends) was -23%. And that total return actually beats the market decline of 25%.

The recent uptick of 4.2% could be a positive sign of things to come, so let's take a look at historical fundamentals.

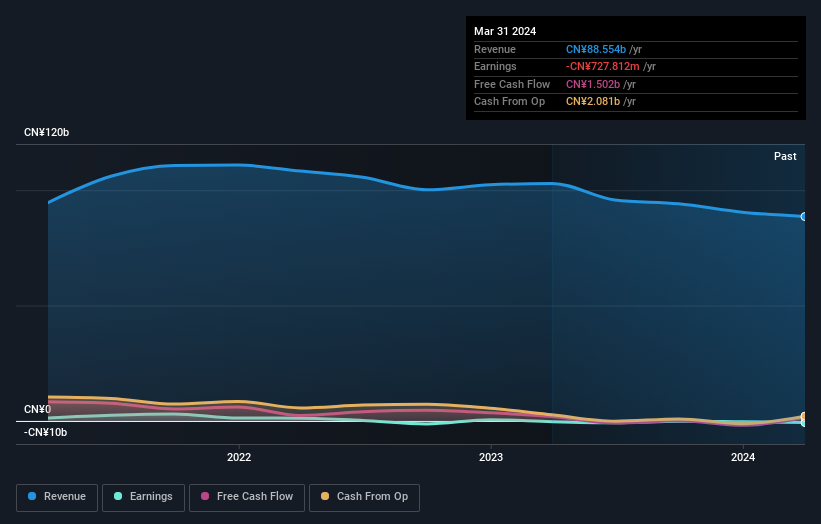

Given that Shandong Iron and Steel didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years, Shandong Iron and Steel's revenue dropped 5.2% per year. That is not a good result. The annual decline of 8% per year in that period has clearly disappointed holders. That makes sense given the lack of either profits or revenue growth. However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

Over the last three years, Shandong Iron and Steel's revenue dropped 5.2% per year. That is not a good result. The annual decline of 8% per year in that period has clearly disappointed holders. That makes sense given the lack of either profits or revenue growth. However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Shandong Iron and Steel's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Shandong Iron and Steel's TSR for the last 3 years was -23%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While it's certainly disappointing to see that Shandong Iron and Steel shares lost 13% throughout the year, that wasn't as bad as the market loss of 16%. Unfortunately, last year's performance may indicate unresolved challenges, given that it's worse than the annualised loss of 3% over the last half decade. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Shandong Iron and Steel has 2 warning signs (and 1 which is significant) we think you should know about.

We will like Shandong Iron and Steel better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com