Chengdu KSW Technologies Co.,Ltd. (SHSE:688283) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 52% share price decline.

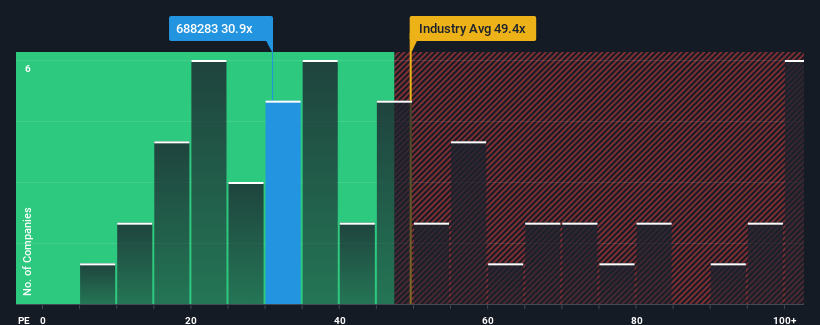

In spite of the heavy fall in price, there still wouldn't be many who think Chengdu KSW TechnologiesLtd's price-to-earnings (or "P/E") ratio of 30.9x is worth a mention when the median P/E in China is similar at about 29x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's superior to most other companies of late, Chengdu KSW TechnologiesLtd has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

What Are Growth Metrics Telling Us About The P/E?

Chengdu KSW TechnologiesLtd's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 14% last year. Pleasingly, EPS has also lifted 60% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 26% per year during the coming three years according to the sole analyst following the company. That's shaping up to be similar to the 25% per year growth forecast for the broader market.

In light of this, it's understandable that Chengdu KSW TechnologiesLtd's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Chengdu KSW TechnologiesLtd's P/E?

Chengdu KSW TechnologiesLtd's plummeting stock price has brought its P/E right back to the rest of the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Chengdu KSW TechnologiesLtd maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Chengdu KSW TechnologiesLtd (1 is concerning!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Chengdu KSW TechnologiesLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com