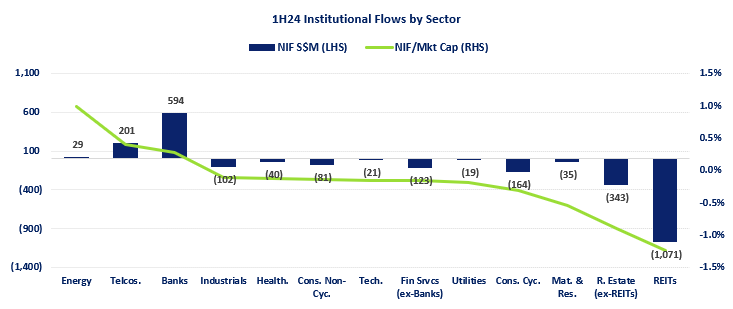

- The STI generated a 2.9% gain to 3,332.8, with dividends boosting the total return to 5.7% in 1H24. The trio of STI Banks, YZJ Shipbuilding & Singtel led the STI gains in 1H24. By Sector, the Banks booked S$594 of net institutional inflow partially offsetting the net institutional outflow for the broader stock market, led by the S-REIT Sector.

- In June, Singtel led the STI stocks with an 11% gain to S$2.75. The stock also booked the highest net institutional inflow for the month. Interest in the stock this year has seen its average daily turnover surge by more than 40% in 1H24 vs CY23. The company recent rolled out its ST28 strategic growth plan & continues to maintain a CETP of S$3.15.

- Proportionate to sector market cap, the Energy Sector saw the highest net institutional inflow in 1H24 at 1.0% with Dyna-Mac, Geo Energy, Mermaid Maritime, Atlantic Navigation, MTQ Corporation and Zheneng Jinjiang Environment booking the most net institutional inflow in the Sector.

The STI gained 2.9% in 1H24, ending June at 3,332.8, with dividends boosting the STI total return to 5.7% in 1H24. This brought the STI total return from the end of 2019, to 30 June 2024, to 25.2% or 5.1% on an annualised basis. Over the same 54 months, the indicative Compound Annual Growth Rate (CAGR) of month-end dollar cost averaging on an STI ETF amounted to 4.2%, excluding transaction costs.

The SPDR STI ETF and Nikko AM Singapore STI ETF experienced net redemptions in 2Q24 as the STI Total Return Index booked all-time highs. Combined STI ETF net redemptions were S$92M in 2Q24 versus net creations of S$97M in 1Q24.

Energy-adjacent stocks, Singtel & STI Banks Led 1H24 Net Institutional Inflows, S-REITs Led Outflows

In 1H24, the broader Singapore stock market booked S$1.175 billion of net institutional outflow, driven by S$1.071 billion of net institutional outflow from the S-REIT Sector. For context, as of 30 June, the total market capitalisation of the Singapore stock market stood at S$793 billion and for every nine stocks that booked net institutional outflow in 1H24, eight stocks booked net institutional inflow.

The net institutional flow (NIF) of the stock Sectors in 1H24 are illustrated below, with the Energy Sector seeing S$29 million of net institutional inflow, representing 1.0% of the combined S$2.9 billion Sector market capitalisation as of 30 June, to the S-REIT Sector net institutional outflow representing 1.2% of its Sector market capitalisation as of 30 June.

United Overseas Bank and Oversea-Chinese Banking Corporation in addition to Singapore Telecommunications and Yangzijiang Shipbuilding Holdings booked the highest net institutional inflow in 1H24. Likewise, three of the strongest growing sectors in the Singapore economy in 1Q24 included Transportation and Storage, Finance & Insurance and Information & Communications.

The 10 stocks that booked the highest net institutional inflow in 1H24 are tabled below.

| Stock | Code | Mkt Cap S$M | 1H24 NIF S$M | 1H24 TR% | 2019 - 30 June 2024 TR % | ROE % | P/B (x) | 5-year Avg P/B (x) | Div Yield % | Sector |

| UOB | U11 | 52,438 | 399 | 13 | 47 | 12.5 | 1.13 | 1.05 | 5.4 | Banks |

| OCBC Bank | O39 | 64,855 | 223 | 14 | 64 | 13.2 | 1.20 | 1.03 | 5.7 | Banks |

| Singtel | Z74 | 45,411 | 217 | 11 | -3 | 3.1 | 1.82 | 1.53 | 3.8 | Telecommunications |

| YZJ Shipbldg SGD | BS6 | 9,718 | 172 | 71 | 423 | 21.3 | 2.49 | 0.88 | 2.6 | Industrials |

| ST Engineering | S63 | 13,504 | 121 | 14 | 35 | 24.1 | 5.48 | 5.14 | 3.7 | Industrials |

| Venture | V03 | 4,125 | 65 | 8 | 8 | 9.5 | 1.46 | 1.85 | 5.3 | Technology |

| ComfortDelGro | C52 | 2,903 | 53 | -2 | -32 | 7.0 | 1.12 | 1.27 | 5.0 | Industrials |

| Great Eastern | G07 | 12,145 | 38 | 49 | 39 | 10.3 | 1.54 | 1.11 | 2.9 | Financial Services |

| Thai Bev | Y92 | 11,307 | 37 | -10 | -40 | 13.7 | 1.53 | 2.66 | 5.0 | Consumer Non-Cyclicals |

| SATS | S58 | 4,248 | 34 | 4 | -40 | 2.4 | 1.79 | 2.48 | 0.5 | Industrials |

Note ADT refers to average daily turnover, NIF refers to Net Institutional Inflow, TR refers to Total Return. Source: SGX, SGX Screener, Refinitiv (Data updated as of 30 June 2024)

As detailed in the table and chart above, with S$217 million of net institutional inflow, Singapore Telecommunications drove the S$201 million Telecommunications Sector's net institutional inflow in 1H24. The stock was the strongest performer in both the STI and a popular global telecommunications stock index in June, with its 11% gain. The stock also saw a significant surge in its average daily turnover (ADT) in 1H24, which was up by more than 40% from CY23.

ST28

On 23 May, Singapore Telecommunications launched ST28, Singtel's new growth plan aimed at enhancing customer experiences and delivering sustained value to shareholders. The plan builds on the successful strategic reset initiated in 2021, focusing on technology and digitalisation. Key areas of focus include connectivity, digital services, and digital infrastructure, with significant investments in 5G. The Group maintain that operational improvements and a capital recycling program have laid a strong foundation for future growth, which the CFO noted in June, has monetised S$8 billion from assets including stakes in Indara (formerly known as Australia Tower Network), Airtel and Nxera to fund growth initiatives since launching in 2021. He added that the Group has identified another S$6 billion in monetisable assets, and will continue to tap external capital partners to jointly fund capital-intensive growth engines.

Energy-adjacent Stocks with Most Net Institutional Inflow in 1H24

Stocks that led the net institutional inflow to the Energy/Oil & Gas sector included Dyna-Mac Holdings, Geo Energy Resources, Mermaid Maritime Public Co, Atlantic Navigation HLDG(S), MTQ Corporation and Zheneng Jinjiang Environment Holding Company. These six stocks generated average and median total returns of 29% in 1H24.

A pioneer in China's Waste-to-Energy (WTE) industry, Zheneng Jinjiang Environment Holding Company also underwent a strategic transformation in 2021, leveraging technology and digitalisation. As of December 2023, the Group had invested in 27 WTE facilities, three kitchen waste treatment facilities and eight waste resource recycling facilities, managing a total waste treatment capacity of 44,405 tonnes per day and generated nearly 4.012 billion kWh of green electricity, enough to power 2.96 million households. The stock generated a 33% total return in 1H24, reducing its decline in total return since the end of 2019 to 36%.

2H24 Key Economic Drivers

The global economic outlook for 2H24 indicates a complex interplay of factors. Policy support in China and rate cuts in advanced economies are expected to stimulate growth, while persistent high rates from the Federal Reserve and geoeconomic fragmentation may pose risks. The semiconductor industry's resurgence and the continued shift towards sustainability are likely to impact manufacturing and exports. Despite potential challenges, such as commodity price volatility and geopolitical tensions, these developments could continue to drive competition and innovation, particularly digitalisation, in the global market.

Market sentiment is currently leaning towards a reduction in the Fed Funds Rate by end September with a significant portion of analysts anticipating a cut. Despite this, inflation expectations remain slightly above the Fed's target, as the PCE Core Deflator is projected to hover around 2.5% to 2.7, as seen in the recently reported May print. Meanwhile, the Jackson Hole Symposium, set for late August, could be pivotal in shaping future monetary policy, as it historically influences central banking decisions and economic discourse. However, according to Nareit officials in 1H24, institutional investors and primary issuers in the US REIT market are very much focused the Federal Reserve actually announcing a rate cut, rather than signalling a cut.

Further Resources and Research

- Weekly Fund Flow Report: Data Reports - Singapore Exchange (SGX)

Recent Financial Results/Business Updates

- UOB: UOB Annual Report 2023

- OCBC: OCBC Annual Report 2023

- Singtel: Singtel Annual Report 2024

- Yangzijiang Shipbuilding: Yangzijiang Shipbuilding 1Q2024 Business Update | Yangzijang Shipbuilding Annual Report 2023

- ST Engineering: ST Engineering 1Q2024 Market Update | ST Engineering Annual Report 2023

- Venture: Venture 1Q2024 Business Update | Venture Annual Report 2023

- ComfortDelGro: ComfortDelGro Annual Report 2023

- Great Eastern: Great Eastern Annual Report 2023

- Thai Bev: Thai Bev 1H24 Financial Results | Thai Bev Annual Report 2023

- Geo Energy Resources: Geo Energy Resources Annual Report 2023

- Mermaid Maritime Public: Mermaid Maritime Public Annual Report 2023

- Atlantic Navigation: Atlantic Navigation Annual Report 2023

- MTQ Corporation: MTQ Corporation Annual Report 2023

- Zheneng Jinjiang Environment: Zheneng Jinjiang Environment Annual Report 2023

Related Analyst Reports

- Singtel: CGS-CIMB - SingTel update : Yield and growth

- SATS: DBS - SATS update : Outperformance across all metrics

- Dyna-Mac: OCBC – Dyna-Mac Holdings Update: Order wins galore

- Geo Energy Resources: KGI Securities – Geo Energy Resources Update: A good time to enter

Company interviews

- Dyna-Mac: kopi-C with Dyna-Mac's CEO: 'We went from near-bankruptcy to having a record order book'

- Singtel: kopi-C with Singtel's Group CFO: 'We create an impact in the lives of more than 700 million people'

Enjoying this read?

- Subscribe now to our SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.