Latham Group, Inc. (NASDAQ:SWIM) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 23% share price drop.

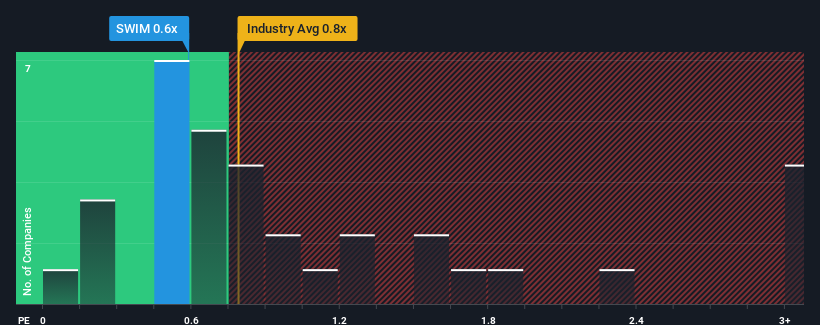

In spite of the heavy fall in price, there still wouldn't be many who think Latham Group's price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in the United States' Leisure industry is similar at about 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Latham Group's P/S Mean For Shareholders?

Recent times haven't been great for Latham Group as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Latham Group.What Are Revenue Growth Metrics Telling Us About The P/S?

Latham Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 7.7% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to plummet, contracting by 4.3% during the coming year according to the seven analysts following the company. Meanwhile, the broader industry is forecast to moderate by 1.0%, which indicates the company should perform poorly indeed.

With this in mind, we find it intriguing that Latham Group's P/S is similar to its industry peers. When revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Latham Group's P/S?

Following Latham Group's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Latham Group's analyst forecasts have revealed that its even shakier outlook against the industry isn't impacting its P/S as much as we would have predicted. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. In addition, we would be concerned whether the company can even maintain this level of performance under these tough industry conditions. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Latham Group (2 are concerning!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com