The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But in contrast you can make much more than 100% if the company does well. To wit, the Shenzhen Mason Technologies Co.,Ltd (SZSE:002654) share price has flown 185% in the last three years. That sort of return is as solid as granite. Then again, the 8.1% share price decline hasn't been so fun for shareholders. This could be related to the soft market, with stocks down around 4.0% in the last month.

The past week has proven to be lucrative for Shenzhen Mason TechnologiesLtd investors, so let's see if fundamentals drove the company's three-year performance.

While Shenzhen Mason TechnologiesLtd made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 3 years Shenzhen Mason TechnologiesLtd saw its revenue grow at 0.6% per year. Considering the company is losing money, we think that rate of revenue growth is uninspiring. In contrast, the stock has popped 42% per year in that time - an impressive result. We'd need to take a closer look at the revenue and profit trends to see whether the improvements might justify that sort of increase. It may be that the market is pretty optimistic about Shenzhen Mason TechnologiesLtd if you look to the bottom line.

In the last 3 years Shenzhen Mason TechnologiesLtd saw its revenue grow at 0.6% per year. Considering the company is losing money, we think that rate of revenue growth is uninspiring. In contrast, the stock has popped 42% per year in that time - an impressive result. We'd need to take a closer look at the revenue and profit trends to see whether the improvements might justify that sort of increase. It may be that the market is pretty optimistic about Shenzhen Mason TechnologiesLtd if you look to the bottom line.

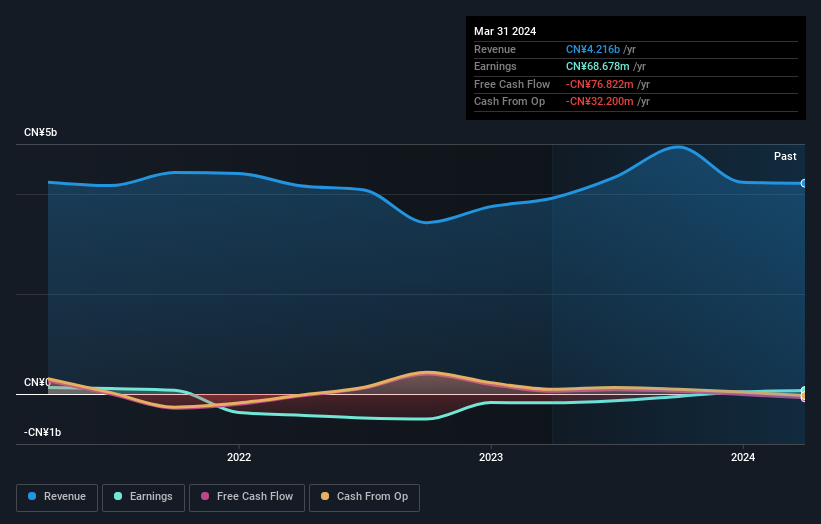

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Shenzhen Mason TechnologiesLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While it's never nice to take a loss, Shenzhen Mason TechnologiesLtd shareholders can take comfort that their trailing twelve month loss of 0.6% wasn't as bad as the market loss of around 17%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 21% for each year. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with Shenzhen Mason TechnologiesLtd .

Of course Shenzhen Mason TechnologiesLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com