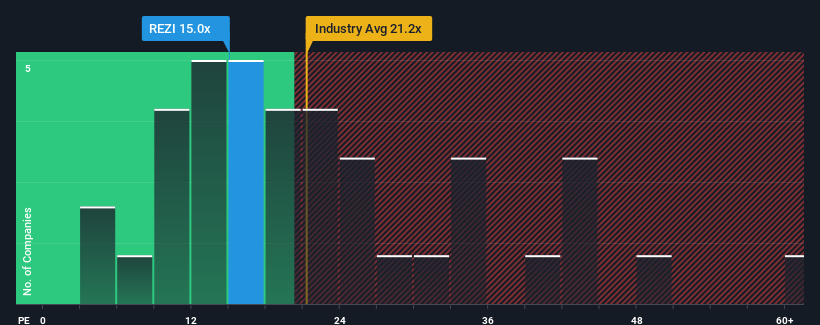

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 18x, you may consider Resideo Technologies, Inc. (NYSE:REZI) as an attractive investment with its 15x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Resideo Technologies has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Does Growth Match The Low P/E?

Resideo Technologies' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 23%. Still, the latest three year period has seen an excellent 64% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 18% per year over the next three years. That's shaping up to be materially higher than the 10% per annum growth forecast for the broader market.

With this information, we find it odd that Resideo Technologies is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Resideo Technologies' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Resideo Technologies you should be aware of.

If you're unsure about the strength of Resideo Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com