Among the seven S-Reit sub-sectors, hospitality S-Reits are the fourth largest in terms of combined market capitalisation.

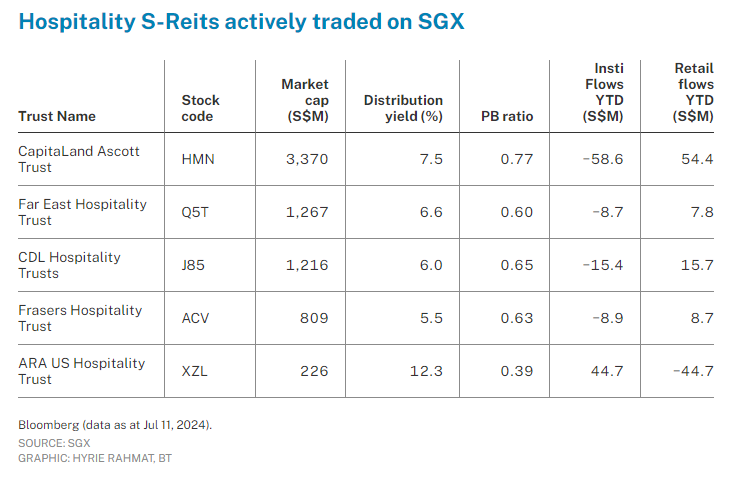

The five actively traded hospitality trusts have an average price-to-book ratio of 0.61 times and an average distribution yield of 7.6 per cent, the second highest across sub-sectors (by market capitalisation-weighted average distribution yields). The five, in terms of market capitalisation, are: CapitaLand Ascott Trust, Far East Hospitality Trust, CDL Hospitality Trusts, Frasers Hospitality Trust, and ARA US Hospitality Trust.

The majority of the five trusts have diversified exposure to international markets, with the exception of two – Far East Hospitality Trust, which has a Singapore-focused hotel and serviced residence portfolio, and ARA US Hospitality Trust, which is a pure-play US hospitality trust.

Most of the hospitality trusts reported higher RevPAR (revenue per available room) across various geographical markets in their latest round of business updates and earnings reports, driven by the continued international travel recovery and stronger demand drivers such as Mice (meetings, incentives, conferences and exhibitions), sports events, and concerts.

Most of the hospitality trusts reported higher RevPAR (revenue per available room) across various geographical markets in their latest round of business updates and earnings reports, driven by the continued international travel recovery and stronger demand drivers such as Mice (meetings, incentives, conferences and exhibitions), sports events, and concerts.

CapitaLand Ascott Trust's (Clas) gross profit in Q1 2024 rose 15 per cent year on year (yoy) on stronger operating performance and contributions from new properties. All its key markets posted positive RevPAU (revenue per available unit) growth yoy, led by Japan, which grew 31 per cent, the UK at 11 per cent and Australia at 8 per cent. Clas recently updated that it has fully acquired a freehold student accommodation property in South Carolina, US, which is expected to generate about 7 per cent Ebitda yield. The property has a pre-leased occupancy rate of 99 per cent for the upcoming academic year with rental growth of 4 per cent and is one of the best-performing accommodation serving the University of South Carolina. Clas will report its H1FY2024 results on Jul 26.

Far East Hospitality Trust's (FEHT) hotel RevPAR grew 6.7 per cent in Q1 2024 with a 1.5 per cent decline in RevPAU for its smaller serviced residence portfolio, due to the expiration of a few long-stay contracts during the earlier part of the quarter. However, average daily rate for both its hotel and serviced residences remained resilient and grew 8.8 per cent and 2.9 per cent, respectively. FEHT will report its H1FY2024 results on Jul 30.

CDL Hospitality Trusts (CDLHT) registered positive RevPAR growth across all its geographical markets in Q1 2024, largely driven by increased occupancies. Markets which led growth were Japan, which grew 32.6 per cent; Italy, up 27.5 per cent; and Singapore, which grew 16.6 per cent in RevPAR yoy. CDLHT notes that international tourism recovery is well on its path towards pre-Covid levels, but headwinds from geopolitical uncertainties continue. For core market Singapore, CDLHT's managers see a promising outlook, and believe the recovery of Chinese arrivals will help create demand compression in the market. CDLHT will report its H1FY2024 results on Jul 30.

Frasers Hospitality Trust, which reported its H1FY2024 results earlier this year, observed higher gross revenue of 1.7 per cent yoy due to a slight improvement in hospitality portfolio performance. However, distribution per stapled security declined 13.7 per cent due mainly to higher finance costs.

Pure-play US upscale select-service hospitality trust, ARA US Hospitality Trust updated that its Q1 2024 gross operating profit and net property income margins for the portfolio improved marginally to 29.5 per cent and 17.8 per cent, respectively. During the quarter, its portfolio occupancy decreased 2.2 percentage points to 59.5 per cent, due to demand displacement from asset enhancement improvement projects at four properties, which are expected to be in a better position to drive revenues and profits moving forward.

REIT Watch is a regular column on The Business Times, read the original version.

Enjoying this read?

- Subscribe now to the SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.