Whales with a lot of money to spend have taken a noticeably bullish stance on JPMorgan Chase.

Looking at options history for JPMorgan Chase (NYSE:JPM) we detected 39 trades.

If we consider the specifics of each trade, it is accurate to state that 53% of the investors opened trades with bullish expectations and 35% with bearish.

From the overall spotted trades, 10 are puts, for a total amount of $2,028,761 and 29, calls, for a total amount of $1,762,462.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $175.0 and $240.0 for JPMorgan Chase, spanning the last three months.

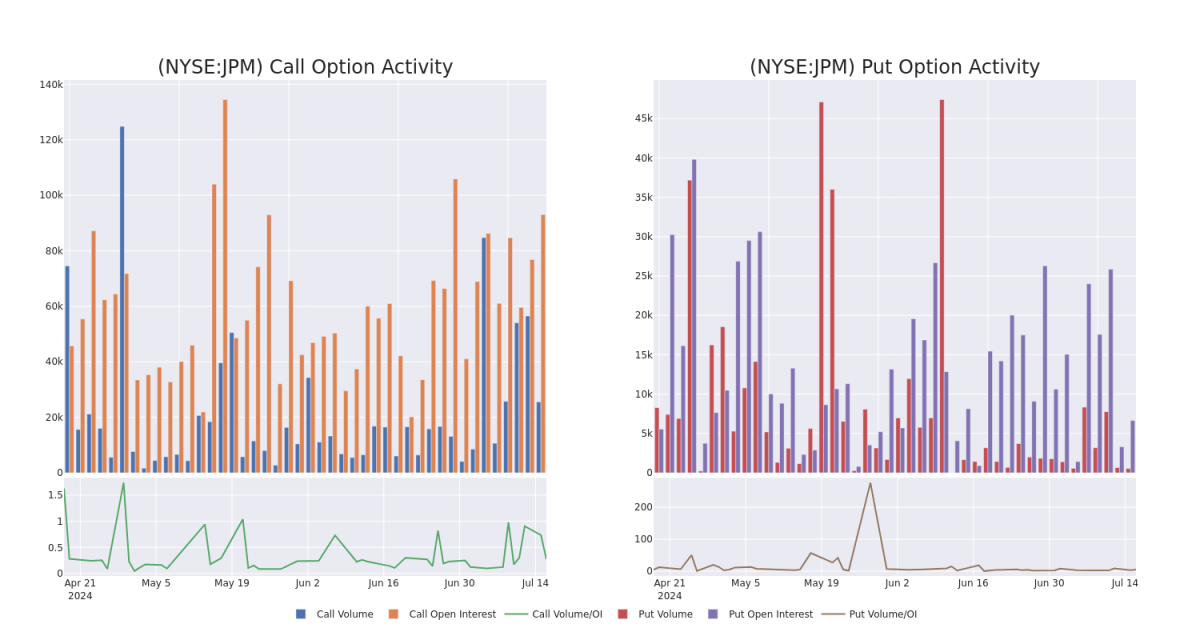

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in JPMorgan Chase's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to JPMorgan Chase's substantial trades, within a strike price spectrum from $175.0 to $240.0 over the preceding 30 days.

JPMorgan Chase Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JPM | PUT | TRADE | BEARISH | 01/16/26 | $11.4 | $11.05 | $11.35 | $190.00 | $1.4M | 1.7K | 0 |

| JPM | CALL | TRADE | BEARISH | 09/20/24 | $8.0 | $7.95 | $7.93 | $210.00 | $232.3K | 5.5K | 238 |

| JPM | CALL | TRADE | BULLISH | 01/17/25 | $3.9 | $3.85 | $3.9 | $240.00 | $193.0K | 7.4K | 1.7K |

| JPM | CALL | SWEEP | BEARISH | 07/19/24 | $6.35 | $6.05 | $6.11 | $205.00 | $123.5K | 5.1K | 407 |

| JPM | PUT | SWEEP | BEARISH | 01/17/25 | $10.45 | $10.35 | $10.45 | $210.00 | $122.2K | 782 | 124 |

About JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $3.9 trillion in assets. It is organized into four major segments--consumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management. JPMorgan operates, and is subject to regulation, in multiple countries.

Having examined the options trading patterns of JPMorgan Chase, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of JPMorgan Chase

- Trading volume stands at 4,193,897, with JPM's price up by 0.75%, positioned at $211.63.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 87 days.

Expert Opinions on JPMorgan Chase

In the last month, 5 experts released ratings on this stock with an average target price of $223.0.

- Consistent in their evaluation, an analyst from Jefferies keeps a Buy rating on JPMorgan Chase with a target price of $239.

- An analyst from Evercore ISI Group persists with their Outperform rating on JPMorgan Chase, maintaining a target price of $210.

- Reflecting concerns, an analyst from Piper Sandler lowers its rating to Overweight with a new price target of $230.

- An analyst from Morgan Stanley has decided to maintain their Overweight rating on JPMorgan Chase, which currently sits at a price target of $221.

- An analyst from Citigroup persists with their Neutral rating on JPMorgan Chase, maintaining a target price of $215.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest JPMorgan Chase options trades with real-time alerts from Benzinga Pro.