It can certainly be frustrating when a stock does not perform as hoped. But it can difficult to make money in a declining market. The Keli Motor Group Co., Ltd. (SZSE:002892) is down 15% over three years, but the total shareholder return is -12% once you include the dividend. That's better than the market which declined 27% over the last three years. Unfortunately the share price momentum is still quite negative, with prices down 9.5% in thirty days. But this could be related to poor market conditions -- stocks are down 4.9% in the same time.

With the stock having lost 7.3% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

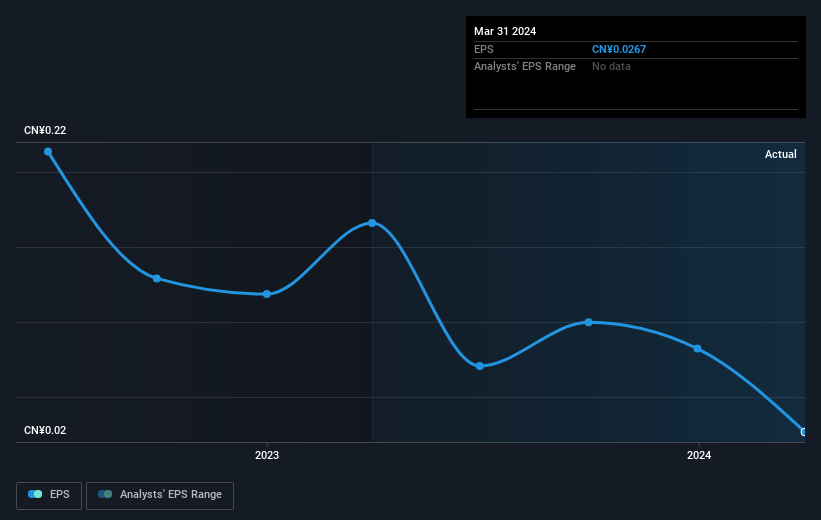

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the three years that the share price fell, Keli Motor Group's earnings per share (EPS) dropped by 47% each year. This fall in the EPS is worse than the 5% compound annual share price fall. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term. With a P/E ratio of 310.72, it's fair to say the market sees a brighter future for the business.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Keli Motor Group's key metrics by checking this interactive graph of Keli Motor Group's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Keli Motor Group, it has a TSR of -12% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Although it hurts that Keli Motor Group returned a loss of 12% in the last twelve months, the broader market was actually worse, returning a loss of 17%. Given the total loss of 1.4% per year over five years, it seems returns have deteriorated in the last twelve months. Whilst Baron Rothschild does tell the investor "buy when there's blood in the streets, even if the blood is your own", buyers would need to examine the data carefully to be comfortable that the business itself is sound. It's always interesting to track share price performance over the longer term. But to understand Keli Motor Group better, we need to consider many other factors. For instance, we've identified 4 warning signs for Keli Motor Group (2 make us uncomfortable) that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com