Most people feel a little frustrated if a stock they own goes down in price. But often it is not a reflection of the fundamental business performance. The Glarun Technology Co.,Ltd (SHSE:600562) is down 17% over a year, but the total shareholder return is -16% once you include the dividend. And that total return actually beats the market decline of 17%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 8.3% in three years. Unfortunately the share price momentum is still quite negative, with prices down 8.2% in thirty days. We do note, however, that the broader market is down 4.6% in that period, and this may have weighed on the share price.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the Glarun TechnologyLtd share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

Even though the Glarun TechnologyLtd share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

It seems quite likely that the market was expecting higher growth from the stock. But other metrics might shed some light on why the share price is down.

With a low yield of 1.1% we doubt that the dividend influences the share price much. Revenue was fairly steady year on year, which isn't usually such a bad thing. But the share price might be lower because the market expected a meaningful improvement, and got none.

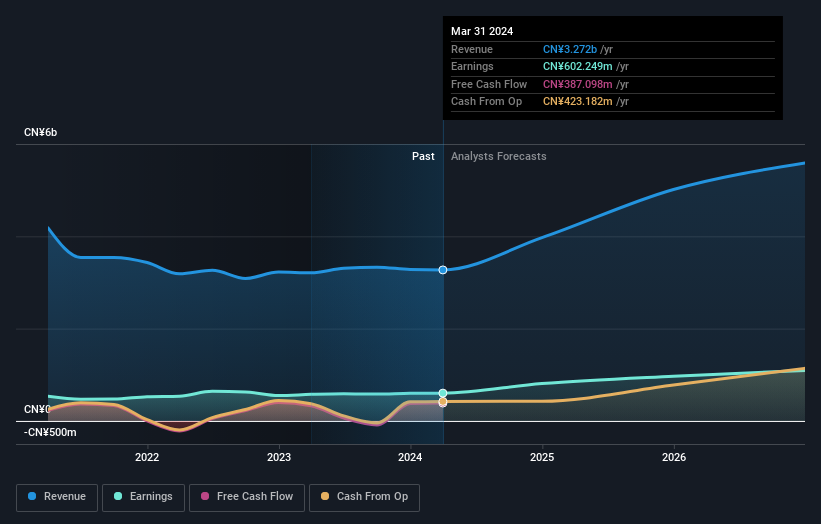

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Glarun TechnologyLtd shareholders are down 16% over twelve months (even including dividends), which isn't far from the market return of -17%. So last year was actually even worse than the last five years, which cost shareholders 2% per year. It will probably take a substantial improvement in the fundamental performance for the company to reverse this trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Glarun TechnologyLtd that you should be aware of.

Of course Glarun TechnologyLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com