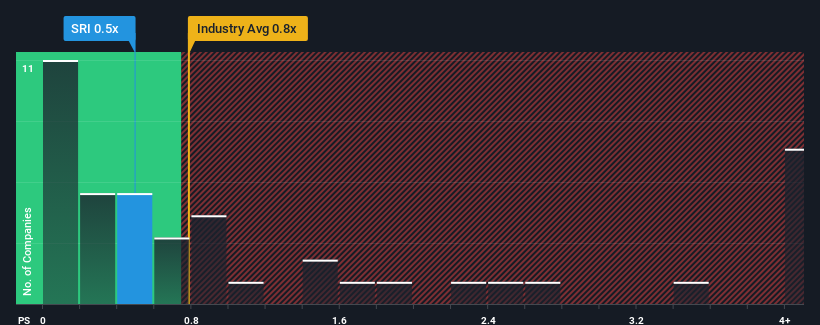

With a median price-to-sales (or "P/S") ratio of close to 0.8x in the Auto Components industry in the United States, you could be forgiven for feeling indifferent about Stoneridge, Inc.'s (NYSE:SRI) P/S ratio of 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does Stoneridge's P/S Mean For Shareholders?

There hasn't been much to differentiate Stoneridge's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Keen to find out how analysts think Stoneridge's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Stoneridge would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 5.8% gain to the company's revenues. Pleasingly, revenue has also lifted 48% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 3.5% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 8.5%, which is noticeably more attractive.

With this in mind, we find it intriguing that Stoneridge's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that Stoneridge's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Before you settle on your opinion, we've discovered 1 warning sign for Stoneridge that you should be aware of.

If you're unsure about the strength of Stoneridge's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com