Financial giants have made a conspicuous bullish move on Deckers Outdoor. Our analysis of options history for Deckers Outdoor (NYSE:DECK) revealed 16 unusual trades.

Delving into the details, we found 37% of traders were bullish, while 6% showed bearish tendencies. Out of all the trades we spotted, 12 were puts, with a value of $1,958,598, and 4 were calls, valued at $117,199.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $860.0 and $1050.0 for Deckers Outdoor, spanning the last three months.

Volume & Open Interest Development

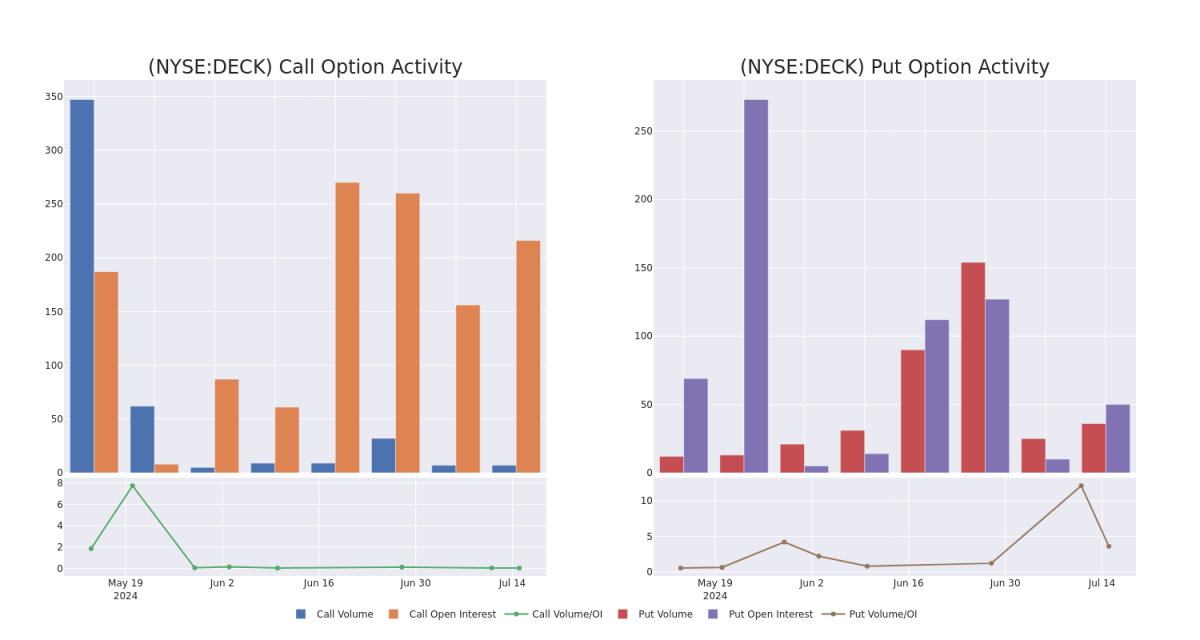

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Deckers Outdoor's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Deckers Outdoor's significant trades, within a strike price range of $860.0 to $1050.0, over the past month.

Deckers Outdoor Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DECK | PUT | TRADE | BULLISH | 12/20/24 | $56.8 | $51.2 | $53.0 | $860.00 | $249.1K | 360 | 120 |

| DECK | PUT | TRADE | BULLISH | 12/20/24 | $56.8 | $51.2 | $53.0 | $860.00 | $243.8K | 360 | 41 |

| DECK | PUT | TRADE | BULLISH | 12/20/24 | $58.2 | $52.1 | $53.2 | $860.00 | $218.1K | 360 | 0 |

| DECK | PUT | TRADE | BULLISH | 12/20/24 | $56.8 | $51.2 | $53.0 | $860.00 | $217.3K | 360 | 167 |

| DECK | PUT | TRADE | NEUTRAL | 12/20/24 | $55.7 | $50.2 | $52.95 | $860.00 | $206.5K | 360 | 237 |

About Deckers Outdoor

Deckers Outdoor Corp designs and sells casual and performance footwear, apparel, and accessories. Primary brands include UGG, Teva, and Sanuk. The company distributes Majority of its products through its wholesale business, but it also has a substantial direct-to-consumer business with its company-owned retail stores and websites. Majority of its sales are in the United States, although the company also has retail stores and distributors throughout Europe, Asia, Canada, and Latin America. It has structured their reporting around six segments which inlcudes the wholesale operations of specific brands like UGG, HOKA, Teva, Sanuk, and Other brands, alongside a segment focused on direct-to-consumer (DTC) operations.

Having examined the options trading patterns of Deckers Outdoor, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Deckers Outdoor's Current Market Status

- With a trading volume of 263,987, the price of DECK is down by -2.22%, reaching $892.63.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 8 days from now.

What The Experts Say On Deckers Outdoor

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $1110.0.

- Reflecting concerns, an analyst from Wedbush lowers its rating to Outperform with a new price target of $1030.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Deckers Outdoor with a target price of $1100.

- An analyst from BTIG has decided to maintain their Buy rating on Deckers Outdoor, which currently sits at a price target of $1200.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.