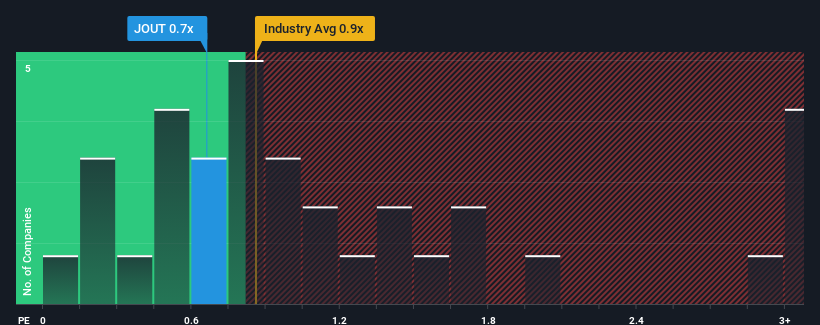

With a median price-to-sales (or "P/S") ratio of close to 0.9x in the Leisure industry in the United States, you could be forgiven for feeling indifferent about Johnson Outdoors Inc.'s (NASDAQ:JOUT) P/S ratio of 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does Johnson Outdoors' Recent Performance Look Like?

Recent times haven't been great for Johnson Outdoors as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Johnson Outdoors' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Johnson Outdoors?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Johnson Outdoors' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 11% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue growth will be highly resilient over the next year growing by 9.9%. That would be an excellent outcome when the industry is expected to decline by 1.2%.

With this information, we find it odd that Johnson Outdoors is trading at a fairly similar P/S to the industry. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Bottom Line On Johnson Outdoors' P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Johnson Outdoors' analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't resulting in the company trading at a higher P/S, as per our expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You need to take note of risks, for example - Johnson Outdoors has 2 warning signs (and 1 which is significant) we think you should know about.

If you're unsure about the strength of Johnson Outdoors' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com