Deep-pocketed investors have adopted a bearish approach towards Viking Therapeutics (NASDAQ:VKTX), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in VKTX usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for Viking Therapeutics. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 0% leaning bullish and 77% bearish. Among these notable options, 4 are puts, totaling $180,170, and 5 are calls, amounting to $377,168.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $75.0 for Viking Therapeutics, spanning the last three months.

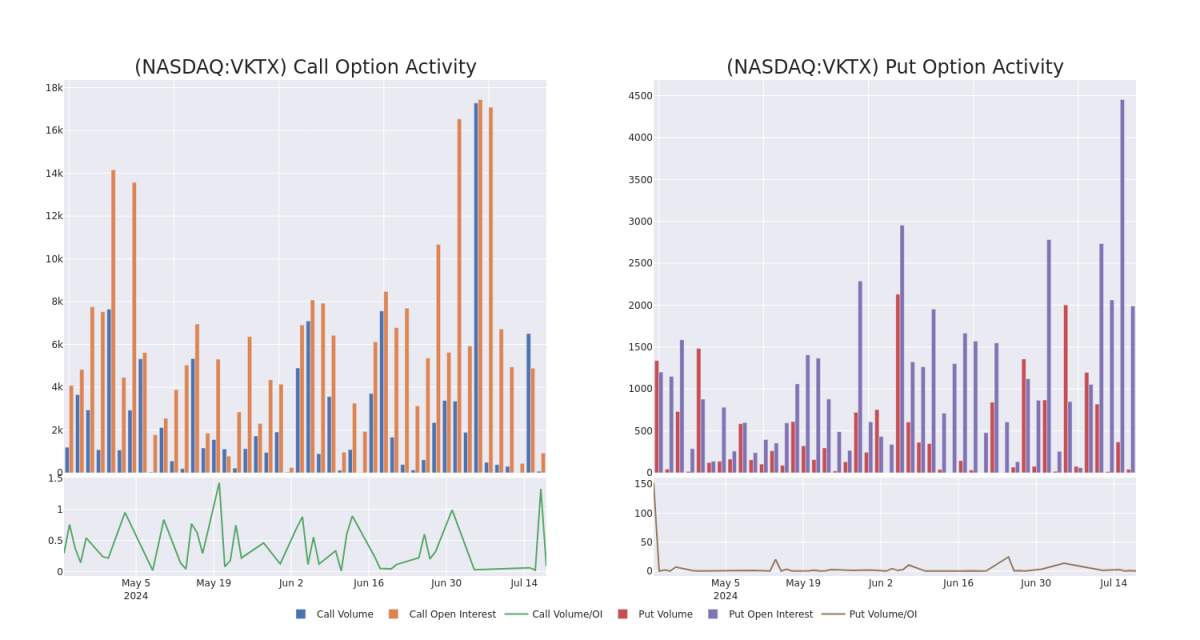

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Viking Therapeutics options trades today is 486.33 with a total volume of 113.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Viking Therapeutics's big money trades within a strike price range of $20.0 to $75.0 over the last 30 days.

Viking Therapeutics Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VKTX | CALL | TRADE | BEARISH | 01/16/26 | $37.0 | $33.3 | $34.73 | $20.00 | $173.6K | 299 | 24 |

| VKTX | CALL | TRADE | NEUTRAL | 01/16/26 | $33.8 | $29.1 | $31.48 | $25.00 | $94.4K | 54 | 30 |

| VKTX | PUT | TRADE | BEARISH | 09/20/24 | $9.1 | $8.6 | $8.91 | $50.00 | $62.3K | 954 | 2 |

| VKTX | PUT | SWEEP | BEARISH | 11/15/24 | $6.0 | $5.9 | $6.0 | $40.00 | $53.4K | 915 | 40 |

| VKTX | CALL | TRADE | BEARISH | 01/16/26 | $37.0 | $35.5 | $35.75 | $20.00 | $39.3K | 299 | 2 |

About Viking Therapeutics

Viking Therapeutics Inc is a healthcare service provider. The company specializes in the area of biopharmaceutical development focused on metabolic and endocrine disorders. The company's clinical program pipeline consists of VK2809, VK5211, VK0214 products. VK2809 and VK0214 are orally available, tissue and receptor-subtype selective agonists of the thyroid hormone receptor beta. VK5211 is an orally available, non-steroidal selective androgen receptor modulator.

Having examined the options trading patterns of Viking Therapeutics, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Viking Therapeutics's Current Market Status

- With a trading volume of 1,554,339, the price of VKTX is down by -0.42%, reaching $49.63.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 6 days from now.

Expert Opinions on Viking Therapeutics

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $97.5.

- In a cautious move, an analyst from Morgan Stanley downgraded its rating to Overweight, setting a price target of $105.

- An analyst from HC Wainwright & Co. downgraded its action to Buy with a price target of $90.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Viking Therapeutics with Benzinga Pro for real-time alerts.