P10, Inc. (NYSE:PX) shares have continued their recent momentum with a 26% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 15% in the last twelve months.

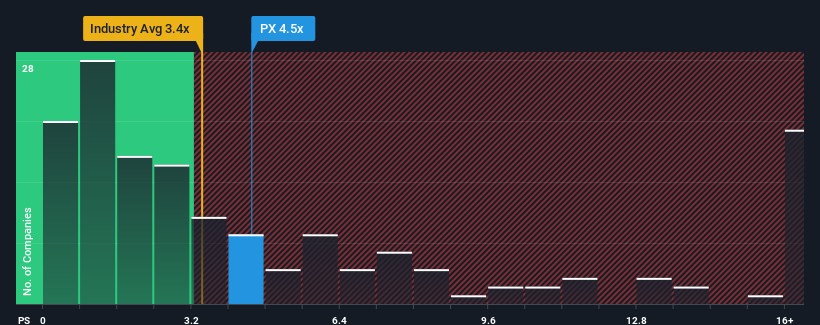

Since its price has surged higher, given close to half the companies operating in the United States' Capital Markets industry have price-to-sales ratios (or "P/S") below 3.4x, you may consider P10 as a stock to potentially avoid with its 4.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

How P10 Has Been Performing

Recent times haven't been great for P10 as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on P10.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like P10's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 190% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 8.8% over the next year. Meanwhile, the rest of the industry is forecast to expand by 7.5%, which is not materially different.

With this in consideration, we find it intriguing that P10's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On P10's P/S

The large bounce in P10's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Analysts are forecasting P10's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware P10 is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on P10, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com