Financial giants have made a conspicuous bullish move on NextEra Energy. Our analysis of options history for NextEra Energy (NYSE:NEE) revealed 10 unusual trades.

Delving into the details, we found 60% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $360,350, and 7 were calls, valued at $484,337.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $47.5 to $80.0 for NextEra Energy during the past quarter.

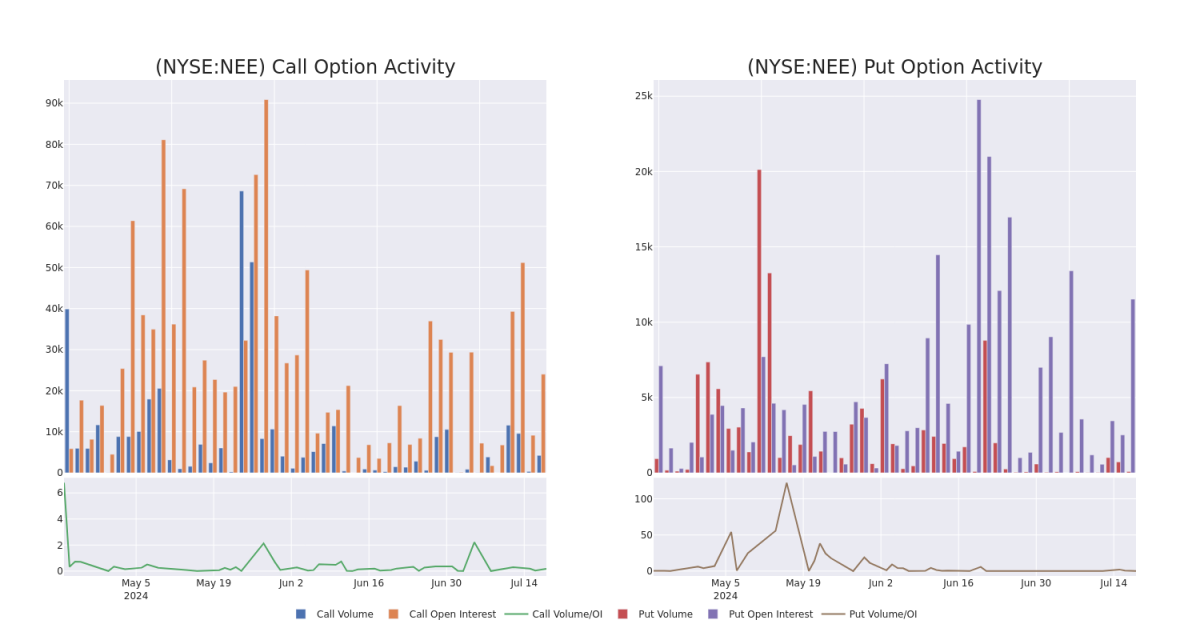

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for NextEra Energy's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across NextEra Energy's significant trades, within a strike price range of $47.5 to $80.0, over the past month.

NextEra Energy Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NEE | PUT | SWEEP | BULLISH | 01/17/25 | $2.99 | $2.72 | $2.72 | $65.00 | $272.0K | 9.7K | 14 |

| NEE | CALL | SWEEP | BULLISH | 07/19/24 | $5.0 | $1.76 | $2.33 | $69.00 | $265.3K | 154 | 0 |

| NEE | CALL | SWEEP | BULLISH | 09/20/24 | $5.8 | $5.7 | $5.8 | $67.50 | $58.5K | 3.5K | 1 |

| NEE | PUT | SWEEP | BULLISH | 12/20/24 | $6.65 | $6.55 | $6.55 | $75.00 | $55.0K | 273 | 0 |

| NEE | CALL | SWEEP | BEARISH | 08/16/24 | $1.16 | $1.15 | $1.15 | $75.00 | $40.3K | 6.8K | 4.2K |

About NextEra Energy

NextEra Energy's regulated utility, Florida Power & Light, is the largest rate-regulated utility in Florida. The utility distributes power to nearly 6 million customer accounts in Florida and owns 34 gigawatts of generation. FP&L contributes roughly 70% of NextEra's consolidated operating earnings. NextEra Energy Resources, the renewable energy segment, generates and sells power throughout the United States and Canada with more than 34 GW of generation capacity, including natural gas, nuclear, wind, and solar.

After a thorough review of the options trading surrounding NextEra Energy, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of NextEra Energy

- Currently trading with a volume of 10,160,578, the NEE's price is up by 1.09%, now at $71.67.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 6 days.

What The Experts Say On NextEra Energy

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $82.25.

- Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on NextEra Energy with a target price of $72.

- An analyst from Citigroup has decided to maintain their Buy rating on NextEra Energy, which currently sits at a price target of $84.

- Maintaining their stance, an analyst from BMO Capital continues to hold a Outperform rating for NextEra Energy, targeting a price of $83.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on NextEra Energy with a target price of $90.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.