Unfortunately for some shareholders, the FriendTimes Inc. (HKG:6820) share price has dived 26% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 33% share price drop.

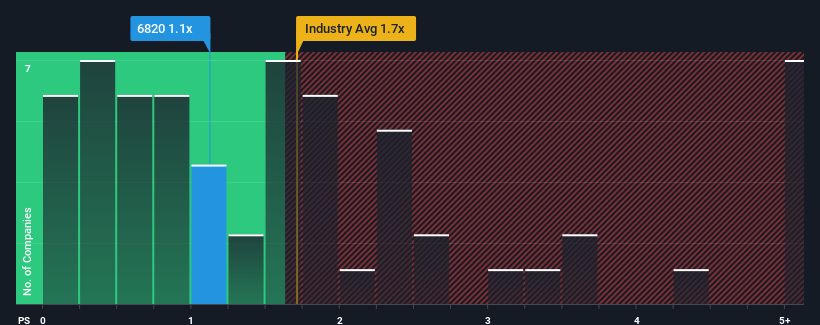

Since its price has dipped substantially, it would be understandable if you think FriendTimes is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 1.1x, considering almost half the companies in Hong Kong's Entertainment industry have P/S ratios above 1.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has FriendTimes Performed Recently?

FriendTimes hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on FriendTimes will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For FriendTimes?

There's an inherent assumption that a company should underperform the industry for P/S ratios like FriendTimes' to be considered reasonable.

There's an inherent assumption that a company should underperform the industry for P/S ratios like FriendTimes' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 31% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 52% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 25% each year over the next three years. That's shaping up to be materially higher than the 18% per year growth forecast for the broader industry.

With this information, we find it odd that FriendTimes is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From FriendTimes' P/S?

FriendTimes' recently weak share price has pulled its P/S back below other Entertainment companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems FriendTimes currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for FriendTimes with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com