As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term EVERTEC, Inc. (NYSE:EVTC) shareholders, since the share price is down 20% in the last three years, falling well short of the market return of around 19%. But it's up 5.4% in the last week.

On a more encouraging note the company has added US$115m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

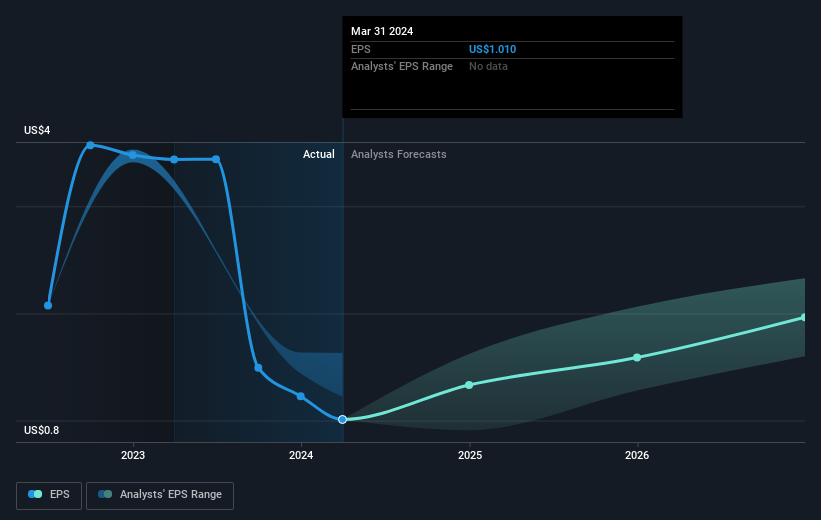

EVERTEC saw its EPS decline at a compound rate of 15% per year, over the last three years. In comparison the 7% compound annual share price decline isn't as bad as the EPS drop-off. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in.

EVERTEC saw its EPS decline at a compound rate of 15% per year, over the last three years. In comparison the 7% compound annual share price decline isn't as bad as the EPS drop-off. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into EVERTEC's key metrics by checking this interactive graph of EVERTEC's earnings, revenue and cash flow.

A Different Perspective

EVERTEC shareholders are down 16% for the year (even including dividends), but the market itself is up 21%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand EVERTEC better, we need to consider many other factors. For instance, we've identified 3 warning signs for EVERTEC (1 is potentially serious) that you should be aware of.

Of course EVERTEC may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com