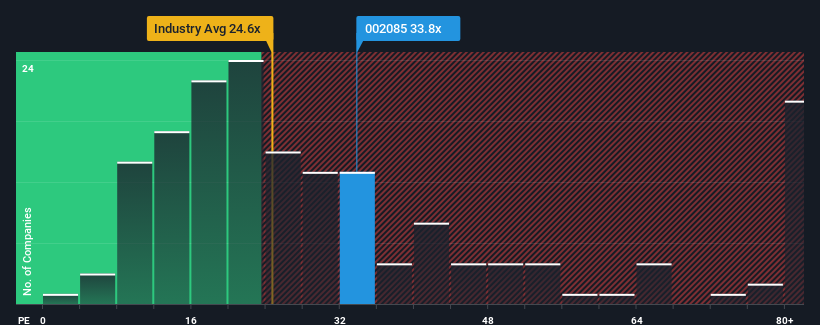

Zhejiang Wanfeng Auto Wheel Co., Ltd.'s (SZSE:002085) price-to-earnings (or "P/E") ratio of 33.8x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 28x and even P/E's below 17x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

As an illustration, earnings have deteriorated at Zhejiang Wanfeng Auto Wheel over the last year, which is not ideal at all. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Zhejiang Wanfeng Auto Wheel would need to produce impressive growth in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 14%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 22% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 14%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 22% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 36% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Zhejiang Wanfeng Auto Wheel is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Zhejiang Wanfeng Auto Wheel's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Zhejiang Wanfeng Auto Wheel revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 3 warning signs for Zhejiang Wanfeng Auto Wheel (1 is a bit unpleasant!) that you should be aware of.

Of course, you might also be able to find a better stock than Zhejiang Wanfeng Auto Wheel. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com