Statistically speaking, long term investing is a profitable endeavour. But unfortunately, some companies simply don't succeed. For example, after five long years the ArcSoft Corporation Limited (SHSE:688088) share price is a whole 61% lower. That's not a lot of fun for true believers. We also note that the stock has performed poorly over the last year, with the share price down 31%. More recently, the share price has dropped a further 12% in a month.

Since ArcSoft has shed CN¥601m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

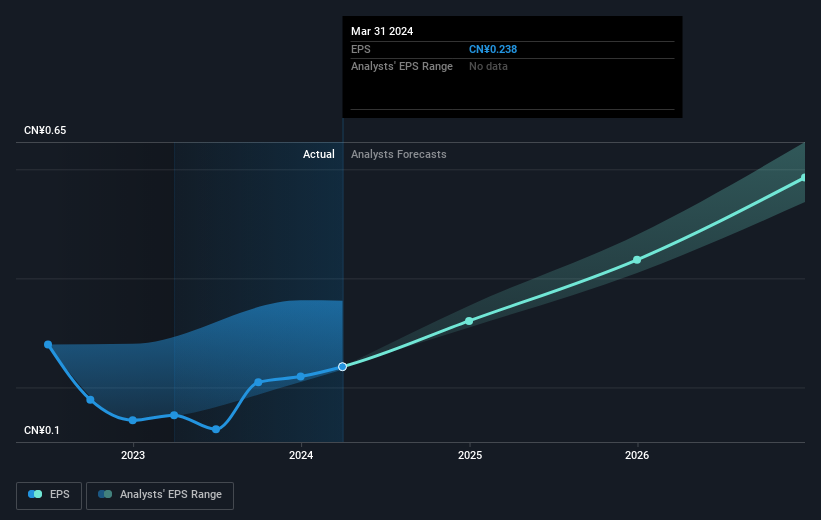

During the five years over which the share price declined, ArcSoft's earnings per share (EPS) dropped by 11% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 17% per year, over the period. So it seems the market was too confident about the business, in the past. Having said that, the market is still optimistic, given the P/E ratio of 110.75.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that ArcSoft has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

While the broader market lost about 15% in the twelve months, ArcSoft shareholders did even worse, losing 31% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that ArcSoft is showing 1 warning sign in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com