Investing in stocks inevitably means buying into some companies that perform poorly. But the long term shareholders of Mango Excellent Media Co., Ltd. (SZSE:300413) have had an unfortunate run in the last three years. Sadly for them, the share price is down 61% in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 44% lower in that time. Furthermore, it's down 13% in about a quarter. That's not much fun for holders.

With the stock having lost 3.7% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate three years of share price decline, Mango Excellent Media actually saw its earnings per share (EPS) improve by 14% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

With a rather small yield of just 0.9% we doubt that the stock's share price is based on its dividend. Arguably the revenue decline of 3.6% per year has people thinking Mango Excellent Media is shrinking. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

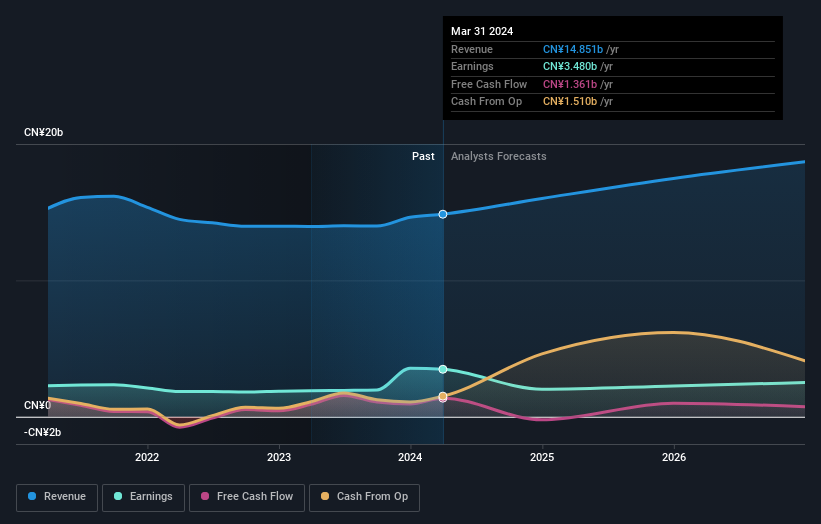

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Mango Excellent Media is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Mango Excellent Media in this interactive graph of future profit estimates.

A Different Perspective

While the broader market lost about 15% in the twelve months, Mango Excellent Media shareholders did even worse, losing 43% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with Mango Excellent Media (including 2 which can't be ignored) .

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com