Deep-pocketed investors have adopted a bullish approach towards PDD Holdings (NASDAQ:PDD), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PDD usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 12 extraordinary options activities for PDD Holdings. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 41% leaning bullish and 33% bearish. Among these notable options, 3 are puts, totaling $492,500, and 9 are calls, amounting to $303,804.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $120.0 to $150.0 for PDD Holdings during the past quarter.

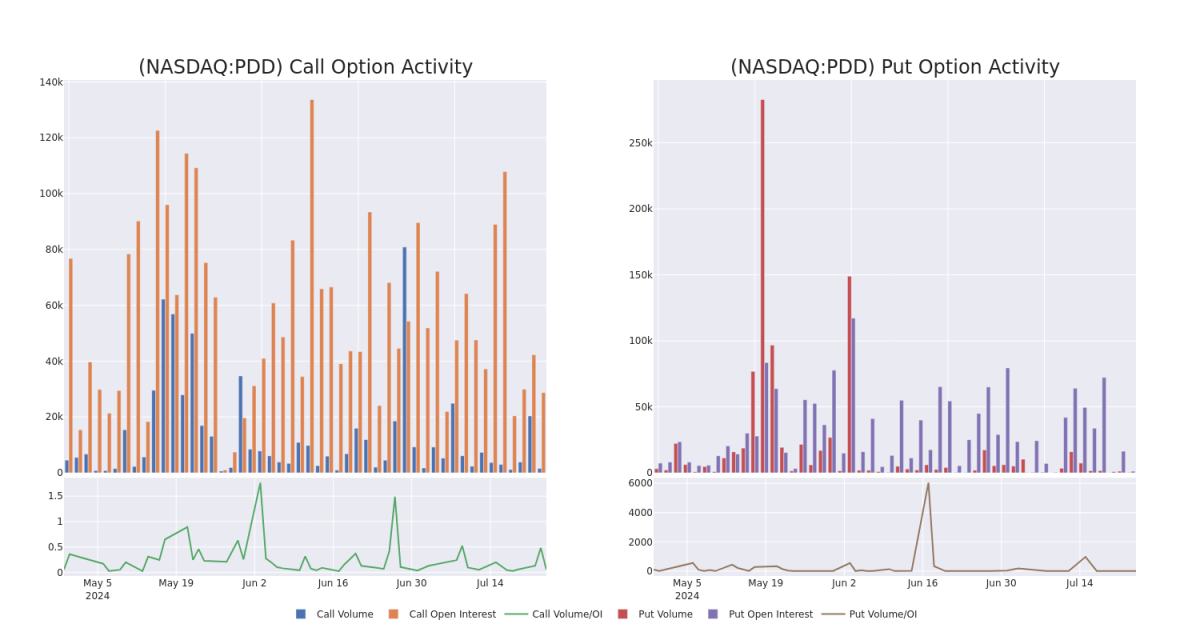

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for PDD Holdings options trades today is 3320.22 with a total volume of 1,925.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for PDD Holdings's big money trades within a strike price range of $120.0 to $150.0 over the last 30 days.

PDD Holdings Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | PUT | TRADE | BULLISH | 06/20/25 | $12.75 | $12.4 | $12.5 | $120.00 | $437.5K | 908 | 350 |

| PDD | CALL | SWEEP | BEARISH | 10/18/24 | $5.5 | $5.3 | $5.3 | $150.00 | $79.5K | 23.5K | 0 |

| PDD | CALL | SWEEP | BEARISH | 08/02/24 | $2.33 | $2.18 | $2.18 | $135.00 | $33.3K | 765 | 734 |

| PDD | PUT | TRADE | NEUTRAL | 08/16/24 | $5.9 | $5.8 | $5.85 | $136.00 | $29.2K | 1 | 1 |

| PDD | CALL | TRADE | BEARISH | 01/17/25 | $19.35 | $19.0 | $19.08 | $130.00 | $28.6K | 1.7K | 21 |

About PDD Holdings

PDD Holdings is a multinational commerce group that owns and operates a portfolio of businesses. PDD aims to bring more businesses and people into the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD has built a network of sourcing, logistics, and fulfillment capabilities that support its underlying businesses.

After a thorough review of the options trading surrounding PDD Holdings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of PDD Holdings

- With a trading volume of 1,680,260, the price of PDD is down by -0.89%, reaching $131.9.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 34 days from now.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for PDD Holdings with Benzinga Pro for real-time alerts.