Financial giants have made a conspicuous bearish move on Linde. Our analysis of options history for Linde (NASDAQ:LIN) revealed 10 unusual trades.

Delving into the details, we found 20% of traders were bullish, while 60% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $65,580, and 8 were calls, valued at $466,188.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $400.0 to $455.0 for Linde over the last 3 months.

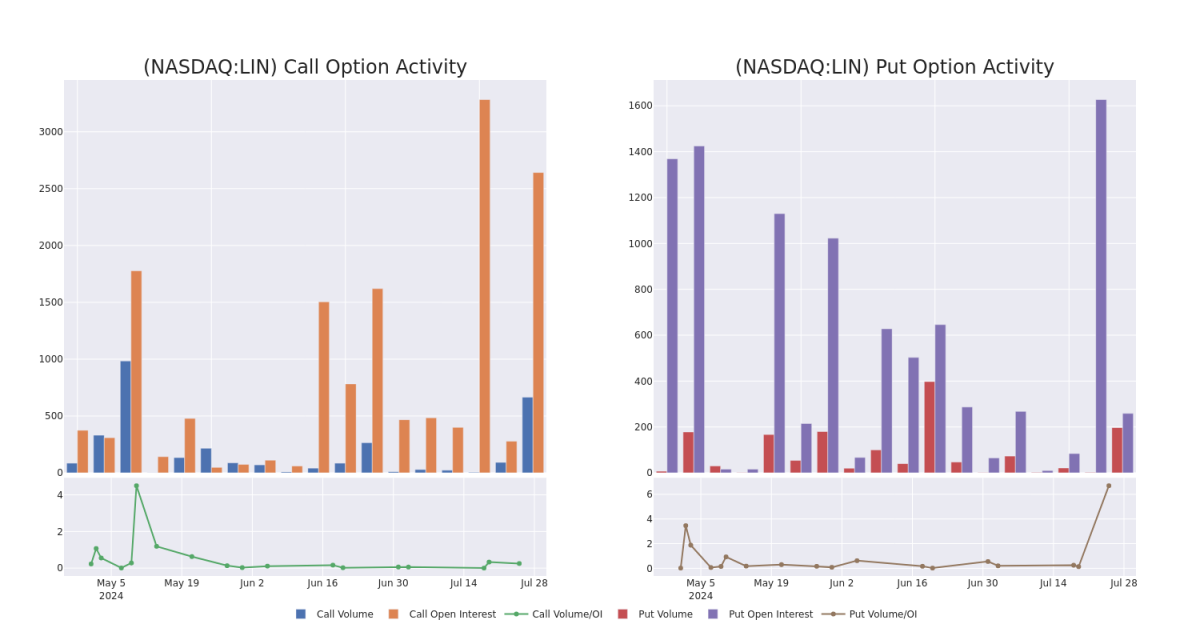

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Linde's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Linde's substantial trades, within a strike price spectrum from $400.0 to $455.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Linde's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Linde's substantial trades, within a strike price spectrum from $400.0 to $455.0 over the preceding 30 days.

Linde Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

| LIN | CALL | SWEEP | BEARISH | 01/17/25 | $27.4 | $26.7 | $26.7 | $450.00 | $95.9K | 2.6K | 35 |

| LIN | CALL | SWEEP | NEUTRAL | 01/17/25 | $26.6 | $26.4 | $26.5 | $450.00 | $74.2K | 2.6K | 165 |

| LIN | CALL | SWEEP | BEARISH | 01/17/25 | $26.8 | $26.7 | $26.58 | $450.00 | $69.2K | 2.6K | 76 |

| LIN | CALL | SWEEP | NEUTRAL | 01/16/26 | $85.1 | $83.2 | $83.8 | $400.00 | $58.7K | 29 | 7 |

| LIN | CALL | SWEEP | BEARISH | 01/17/25 | $27.9 | $26.7 | $26.58 | $450.00 | $58.5K | 2.6K | 98 |

About Linde

Linde is the largest industrial gas supplier in the world, with operations in over 100 countries. The firm's main products are atmospheric gases (including oxygen, nitrogen, and argon) and process gases (including hydrogen, carbon dioxide, and helium), as well as equipment used in industrial gas production. Linde serves a wide variety of end markets, including chemicals, manufacturing, healthcare, and steelmaking. Linde generated approximately $33 billion in revenue in 2023.

Having examined the options trading patterns of Linde, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Linde

- With a volume of 773,982, the price of LIN is up 0.57% at $446.31.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 8 days.

What The Experts Say On Linde

2 market experts have recently issued ratings for this stock, with a consensus target price of $477.5.

- An analyst from UBS persists with their Neutral rating on Linde, maintaining a target price of $475.

- Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Linde, targeting a price of $480.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Linde options trades with real-time alerts from Benzinga Pro.

金融大手は、Lindeに対して目立つ弱気の動きを見せています。Linde(NASDAQ:LIN)のオプション履歴の分析から明らかになったのは、10の異例の取引でした。

詳細を調べると、トレーダーの20%が強気で、60%が弱気志向であることがわかりました。私たちが見つけたすべての取引のうち、2つはプットで、価値は65,580ドルであり、8つはコールで、価値は466,188ドルでした。

予想される価格の変動

これらの契約の出来高と建玉を考慮すると、過去3か月間にわたってLindeの株価範囲を400.0ドルから455.0ドルにターゲットにしたクジラがいるようです。

出来高と建玉に関する洞察力

出来高と建玉を評価することは、オプション取引における戦略的なステップです。これらの指標は、指定された権利行使価格でのLindeのオプションの流動性と投資家の関心を明らかにします。今後のデータは、過去30日間における400.0ドルから455.0ドルの権利行使価格スペクトラム内のコールとプットの出来高および建玉の変動をリンクする大口取引データを可視化します。

出来高と建玉を評価することは、オプション取引における戦略的なステップです。これらの指標は、指定された権利行使価格でのLindeのオプションの流動性と投資家の関心を明らかにします。今後のデータは、過去30日間における400.0ドルから455.0ドルの権利行使価格スペクトラム内のコールとプットの出来高および建玉の変動をリンクする大口取引データを可視化します。

Lindeコールとプットの出来高:30日間の概要

検出された重要なオプション取引:

| シンボル | プット/コール | 取引タイプ | センチメント | 権利行使日 | 売気配 | 買気配 | 価格 | 権利行使価格 | トータル取引価格 | 建玉 | 出来高 |

|---|

| リンデ | コール | スイープ | 弱気 | 01/17/25 | $27.4 | $26.7 | $26.7 | $450.00 | $95.9K | 2.6K | 35 |

| リンデ | コール | スイープ | ニュートラル | 01/17/25 | $26.6 | $26.4 | $26.5 | $450.00 | $74.2K | 2.6K | 165 |

| リンデ | コール | スイープ | 弱気 | 01/17/25 | $26.8 | $26.7 | $26.58 | $450.00 | 69.2千ドル | 2.6K | 76 |

| リンデ | コール | スイープ | ニュートラル | 01/16/26 | $85.1 | $83.2 | $83.8 | $400.00 | $58.7K | 29 | 7 |

| リンデ | コール | スイープ | 弱気 | 01/17/25 | $27.9 | $26.7 | $26.58 | $450.00 | 58500ドル | 2.6K | 98 |

リンデについて

Lindeは、100か国以上で事業を展開する世界最大の産業用ガスサプライヤーです。同社の主要製品は、大気ガス(酸素、窒素、アルゴンなど)およびプロセスガス(水素、二酸化炭素、ヘリウムなど)、また産業用ガス生産に使用される設備です。 Lindeは、化学、製造業、ヘルスケア、鉄鋼製造を含む多様なエンドマーケットにサービスを提供しています。 Lindeは、2023年に約330億ドルの収益を上げました。

Linのオプション取引パターンを調べた後、私たちの注目は直接会社に向けられます。この転換により、現在の市場ポジションとパフォーマンスに深く入り込むことができます

Lindeの現在位置

- 出来高が773,982で、LINの価格は0.57%上昇し、446.31ドルです。

- RSIの指標が、株価が買われすぎに近づいていることを示唆しています。

- 次の収益発表は8日後に予定されています。

リンデに関する専門家の意見

市場専門家2名がこの株式についての評価を発表し、目標株価は477.5ドルで一致しています。

- UBSのアナリストは、リンデのニュートラルな評価を維持し、目標株価を475ドルに維持しています。

- シティグループのアナリストは持ち続けており、リンデに対してニュートラルな評価を維持し、480ドルの価格を目指しています。

オプション取引は、より高いリスクと潜在的なリターンを持っています。賢明なトレーダーは、自己を常に教育し、戦略を適応させ、複数の指標を監視し、市場動向を密かに監視することで、これらのリスクを管理しています。ベンジン・プロからのリアルタイムアラートで、最新のリンデオプション取引に関する情報を入手しましょう。

出来高と建玉を評価することは、オプション取引における戦略的なステップです。これらの指標は、指定された権利行使価格でのLindeのオプションの流動性と投資家の関心を明らかにします。今後のデータは、過去30日間における400.0ドルから455.0ドルの権利行使価格スペクトラム内のコールとプットの出来高および建玉の変動をリンクする大口取引データを可視化します。

出来高と建玉を評価することは、オプション取引における戦略的なステップです。これらの指標は、指定された権利行使価格でのLindeのオプションの流動性と投資家の関心を明らかにします。今後のデータは、過去30日間における400.0ドルから455.0ドルの権利行使価格スペクトラム内のコールとプットの出来高および建玉の変動をリンクする大口取引データを可視化します。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Linde's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Linde's substantial trades, within a strike price spectrum from $400.0 to $455.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Linde's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Linde's substantial trades, within a strike price spectrum from $400.0 to $455.0 over the preceding 30 days.