Despite an already strong run, Lincoln Educational Services Corporation (NASDAQ:LINC) shares have been powering on, with a gain of 32% in the last thirty days. The last 30 days bring the annual gain to a very sharp 96%.

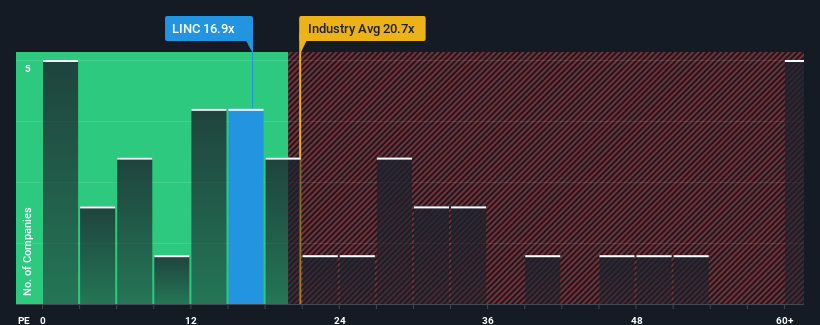

Even after such a large jump in price, it's still not a stretch to say that Lincoln Educational Services' price-to-earnings (or "P/E") ratio of 16.9x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 18x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Lincoln Educational Services has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

How Is Lincoln Educational Services' Growth Trending?

In order to justify its P/E ratio, Lincoln Educational Services would need to produce growth that's similar to the market.

In order to justify its P/E ratio, Lincoln Educational Services would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 153% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 51% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 53% during the coming year according to the four analysts following the company. With the market predicted to deliver 13% growth , that's a disappointing outcome.

With this information, we find it concerning that Lincoln Educational Services is trading at a fairly similar P/E to the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Bottom Line On Lincoln Educational Services' P/E

Lincoln Educational Services' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Lincoln Educational Services currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Lincoln Educational Services (at least 2 which are a bit concerning), and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than Lincoln Educational Services. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com