The Poly Union Chemical Holding Group Co., Ltd. (SZSE:002037) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 41% share price drop.

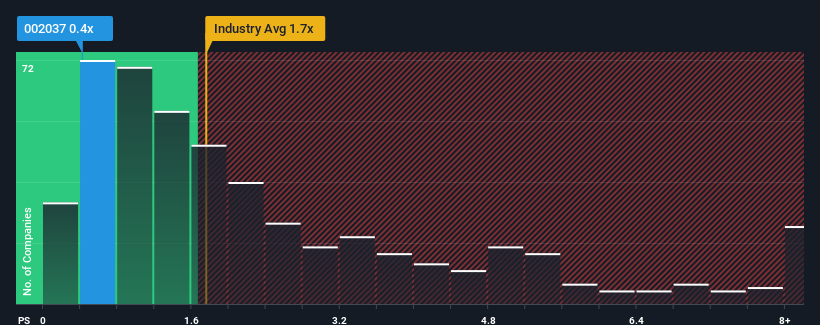

After such a large drop in price, Poly Union Chemical Holding Group's price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Chemicals industry in China, where around half of the companies have P/S ratios above 1.7x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Poly Union Chemical Holding Group Has Been Performing

We'd have to say that with no tangible growth over the last year, Poly Union Chemical Holding Group's revenue has been unimpressive. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Poly Union Chemical Holding Group will help you shine a light on its historical performance.How Is Poly Union Chemical Holding Group's Revenue Growth Trending?

In order to justify its P/S ratio, Poly Union Chemical Holding Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The longer-term trend has been no better as the company has no revenue growth to show for over the last three years either. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 24% shows it's noticeably less attractive.

With this information, we can see why Poly Union Chemical Holding Group is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Poly Union Chemical Holding Group's P/S

Poly Union Chemical Holding Group's P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

In line with expectations, Poly Union Chemical Holding Group maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 3 warning signs we've spotted with Poly Union Chemical Holding Group.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com