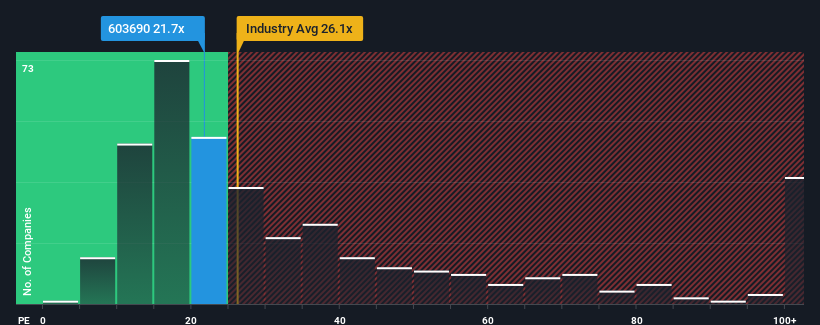

PNC Process Systems Co., Ltd.'s (SHSE:603690) price-to-earnings (or "P/E") ratio of 21.7x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 27x and even P/E's above 51x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

PNC Process Systems certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Is There Any Growth For PNC Process Systems?

In order to justify its P/E ratio, PNC Process Systems would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 25% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 8.9% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Taking a look back first, we see that the company grew earnings per share by an impressive 25% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 8.9% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 25% per annum as estimated by the lone analyst watching the company. With the market predicted to deliver 24% growth per annum, the company is positioned for a comparable earnings result.

With this information, we find it odd that PNC Process Systems is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of PNC Process Systems' analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Having said that, be aware PNC Process Systems is showing 3 warning signs in our investment analysis, and 2 of those are potentially serious.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com