Alta Equipment Group Inc. (NYSE:ALTG) shareholders are no doubt pleased to see that the share price has bounced 33% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 31% over that time.

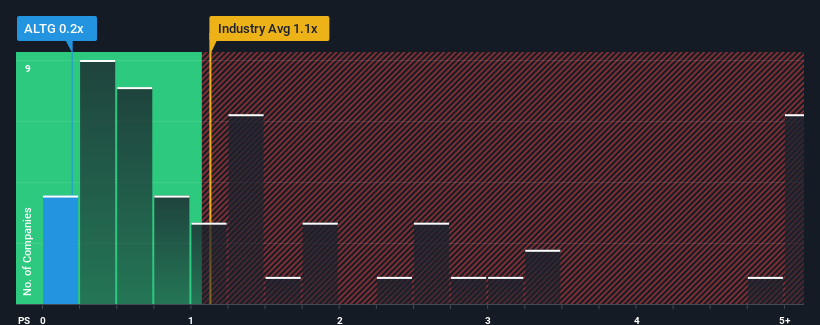

Although its price has surged higher, it would still be understandable if you think Alta Equipment Group is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in the United States' Trade Distributors industry have P/S ratios above 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Alta Equipment Group's P/S Mean For Shareholders?

Alta Equipment Group could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Alta Equipment Group.Is There Any Revenue Growth Forecasted For Alta Equipment Group?

Alta Equipment Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. This was backed up an excellent period prior to see revenue up by 97% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 6.1% during the coming year according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 5.2%, which is not materially different.

With this information, we find it odd that Alta Equipment Group is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift Alta Equipment Group's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Alta Equipment Group's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Alta Equipment Group (1 is a bit unpleasant) you should be aware of.

If you're unsure about the strength of Alta Equipment Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com